The purpose of the PRIX index is to forecast political developments that can affect oil exports from the world’s 20 largest oil exporters. The exports from these countries are in turn an important factor in determining the oil price.

The PRIX global index number for the second quarter of 2015 is 55.87. The range of possible index values is 0-100, where 0 represents a maximum reduction in oil exports, 100 represents a maximum increase in exports, and 50 represents no change. Thus the value for this quarter is clearly above the middle of the range and a rise from the first quarter of 2015, when the global index number was 52.63. This means that political developments in the 20 largest oil-exporting countries point towards a rise in exports during the coming three months. If this comes true and if other factors remain stable, it means that oil prices may fall from current levels.

In this round of the index we have expanded the number countries covered from 15 to 20, and the number Country Analysts from 189 to 293.

The index number without decimals will be posted on the index website prixindex.net

As a Country Analyst, you get the number before the public, as well as detailed information that will not be put on the website: the index number with two decimals, separate index numbers for each of the 20 countries covered by the index, the number of Country Analysts who provided input for the index and the convergence between their opinions.

| Index value | ||

| Country | Q2 | Q1 |

| Iraq | 80.43 | 58.33 |

| Iran | 76.32 | 56.67 |

| Angola | 65.38 | 68.75 |

| Canada | 64.29 | |

| Russia | 60.00 | 48.39 |

| Saudi Arabia | 59.52 | 56.25 |

| Mexico | 53.85 | 50.00 |

| Oman | 50.00 | 75.00 |

| The UAE | 50.00 | 65.00 |

| Norway | 50.00 | |

| Ecuador | 50.00 | |

| Kuwait | 50.00 | 50.00 |

| Qatar | 50.00 | 50.00 |

| Nigeria | 48.21 | 42.50 |

| Kazakhstan | 47.73 | 48.21 |

| Venezuela | 45.00 | 28.57 |

| Algeria | 43.75 | 50.00 |

| Colombia | 40.91 | |

| Libya | 30.00 | 22.73 |

| Azerbaijan | 26.67 | |

| Weighted average | 55.87 | 52.63 |

Table 1. Country-level PRIX index numbers for first and second quarter of 2015 compared

0=max decline in exports, 100=max increase in exports

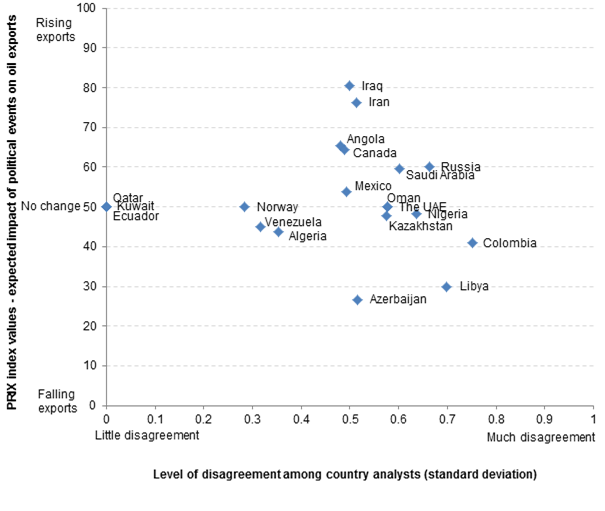

As can be seen from Table 1, Iraq, Iran and Angola are the countries where political developments are expected to be most conducive to rising oil exports. In the case of Iraq and Iran the numbers are quite dramatic. Meanwhile the situation in Azerbaijan, Libya and Colombia is considered to be most conducive to falling oil exports. The largest changes from the first to the second quarter of 2015 were in Iraq, Iran and Venezuela (which shifted towards expectations of rising oil exports), and Oman, the UAE and Algeria (which shifted towards expectations of falling oil exports).

Convergence

Standard deviation provides a measure of the agreement/disagreement of Country Analysts on each of the countries. If all Country Analysts give the same assessment for a country, the standard deviation is 0. The greater the standard deviation, the more divergent the views of the country analysts. Such divergence can serve as an indication of the clarity and predictability of the political situation in the countries. When Country Analysts tend towards unanimity, the political trajectory of a country is probably more predictable (independently of whether it is stable or not, in the sense that it may be stably unstable); and vice versa, when Country Analysts give contradictory input about a country, the trajectory may be less predictable.

| Country | Agreement | |

| Q2 | Q1 | |

| Colombia | 0.75 | |

| Libya | 0.70 | 0.69 |

| Russia | 0.66 | 0.55 |

| Nigeria | 0.64 | 0.81 |

| Saudi Arabia | 0.60 | 0.35 |

| Oman | 0.58 | 0.55 |

| The UAE | 0.58 | 0.67 |

| Kazakhstan | 0.58 | 0.69 |

| Azerbaijan | 0.52 | |

| Iran | 0.51 | 0.64 |

| Iraq | 0.50 | 0.41 |

| Mexico | 0.49 | 0.50 |

| Canada | 0.49 | |

| Angola | 0.48 | 0.52 |

| Algeria | 0.35 | 0.67 |

| Venezuela | 0.32 | 0.79 |

| Norway | 0.28 | |

| Ecuador | 0.00 | |

| Kuwait | 0.00 | 0.63 |

| Qatar | 0.00 | 0.53 |

| Weighted average | 0.51 | 0.55 |

Table 2. Agreement between Country Analysts measured as standard deviation.

0=max agreement, 1= max disagreement

According to Table 2, there was greatest disagreement among the Country Analysts on Colombia, Libya and Russia; and least disagreement among Country Analysts on Ecuador, Kuwait and Qatar. The table also shows that the disagreement among Country Analysts increased most from the first quarter to the second quarter in Saudi Arabia, Russia and Iraq – indicating that the political trajectories of these countries and the consequences for their oil exports is becoming less clear. The disagreement decreased most in Kuwait, Qatar and Venezuela, indicating that these countries’ politics and oil exports are becoming clearer.

In the last round of the survey, Fleiss’s kappa was used to assess the degree of convergence/divergence between country analysts. However, a problem with Fleiss kappa is that it is meant to handle categorical data. There has been some discussion about whether the PRIX index scale (decreased, unchanged or increased exports) are categorical or ordinal, but we currently see them as ordinal and thus Fleiss kappa may not be accurate applied to these data. Instead we are therefore simply using standard deviation (sample method) to measure convergence.

Figure 1. Scatterplot of PRIX index values and standard deviation

Comment here