Water injection scheme now not expected to be completed before 2020

BAGHDAD—A stalled project aimed at sustaining Iraq’s record oil production has become a symbol of missed opportunities for a country reeling from the fall in crude prices and the war against Islamic State.

The government has ramped up production to meet its large payroll and fund the battle against the Sunni Muslim extremist group which now controls large parts of the country.

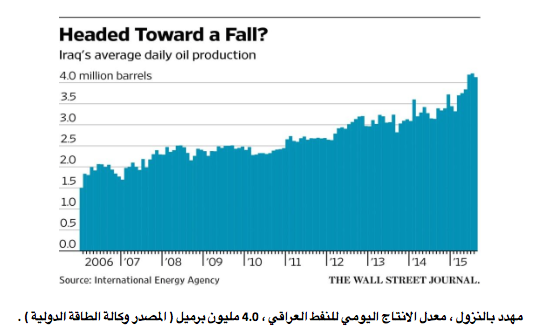

Iraq had hoped to expand output beyond its current level of more than 4 million barrels a day by injecting seawater from the Persian Gulf into its southern oil fields to extract the remaining resources. But now, the project isn’t expected to be completed until 2020 at the earliest—seven years behind schedule.

Without it, production in the southern oil wells is expected to fall by some 10% a year, said Michael Cohen, head of energy commodities research at Barclays.

The faltering venture, known as the Common Seawater Supply Facility, has become another example of how bureaucratic infighting and ethnic and sectarian tensions have stymied efforts to modernize Iraq’s oil sector and move it up the ranks of global producers.

ENLARGE

“The common seawater injection project is a microcosm of all of the different challenges that Iraq is going to need to overcome,” said Raad al-Kadiri, the managing director for Petroleum Sector Risk at IHS Energy, a Colorado-based energy consultancy.

The continuing delays add to the uncertainty surrounding Iraq’s oil industry and the oil-dependent government’s efforts to restore political stability.

In a Sept. 6 letter to the international oil companies running the country’s energy sector,an Iraqi Oil Ministry official warned that government spending for the sector will be cut in 2016.

Even before the warning, Baghdad’s shrinking oil revenue had forced it to slash spending by nearly half for the maintenance and improvement of the country’s oil fields, ports and pipelines.

The worries surrounding Iraq’s oil sector have been compounded by a dispute with the Kurdistan regional administration over a deal to market its oil through the central government.

The disagreement has cost Baghdad badly needed revenue, as a nuclear accord between Iran and six world powers could bring billions of barrels of oil onto the global market as early as next year, putting further downward pressure on prices.

By the end of the year, Iraq will likely owe more than $8 billion to foreign oil companies that extract its oil, said Ali M’arech, a member of the Iraqi parliament’s oil committee.

The government paid some $9 billion in such fees earlier this year, Iraqi Oil Minister Adel Abdul Mehdi wrote in an article published last month in Baghdad’s Al Adala newspaper. He said Iraq planned to pay this year’s oil bills in installments.

Executives of large foreign oil companies complain that many Iraqi policy makers aren’t taking the oil price downturn and its budget impact seriously enough.

“It took a while for the government to accept that there was an issue,” said an employee of a foreign oil company operating in Iraq. “They were almost counting on oil prices bouncing back within a year.”

In July, 4.2 million barrels a day were churned out, up from 3.4 million barrels in November, according to the International Energy Agency. More than three-fourths of it came from the southern region of Basra.

The increased production still hasn’t kept pace with government spending. Baghdad’s budget shortfall is expected to reach $21 billion this year, according to official figures. Meanwhile, the upkeep and improvements to ensure the oil industry’s long-term health have languished.

“The longer and longer that investment is deferred, the more aggressive the decline becomes,” said Mr. Cohen of Barclays.

Water injection is a commonly used method to replace extracted oil and maintain the necessary pressure to continue production. The technique requires less energy and is cheaper than increasing drilling capacity.

Before the U.S.-led invasion of Iraq in 2003, Iraqi firms pumped river water into the southern oil fields to keep the crude flowing. But after Turkey built dams upstream on the Tigris, reducing the water available for pumping into oil fields, Iraqi policy makers began considering a massive saltwater injection project.

When planning for the Common Seawater Supply Facility started in 2009, its goal was to deliver 12 million barrels of water a day to five oil fields by 2013.

In 2010, the government awarded the project contract to Exxon Mobil Corp. A year later, however, the contract was suspended after the oil giant signed an oil extraction deal with Baghdad’s Kurdish rivals in northern Iraq.

Exxon Mobil, along with several other large international oil companies, declined to comment for this article.

The venture was then handed to Iraq’s state-owned South Oil Company, which began in 2012 studying routes for pipelines and possible locations for pumping stations and water treatment stations.

Diplomats and Iraqi politicians blame the continuing delays on bureaucratic infighting between Iraq’s Oil Ministry and its Finance Ministry, which disagree over who should foot the bill for the project.

Noora al-Bachari, a member of the economy committee in parliament, said the dispute could have been avoided had the Oil Ministry brought in a large international oil firm to undertake the project rather than rely on the Finance Ministry. In June 2014, the government turned abroad again in search of a contractor for the project.

“The Oil Ministry should have dealt with this project in a more professional way,” she said.

The Finance Ministry and Oil Ministry didn’t respond to repeated requests for comment.

To sweeten the deal for foreign firms, the Oil Ministry decided early this year to allow the winning bidder access to Iraq’s largely untapped and undeveloped Ibn Omar oil field, said Mr. M’arech, the parliamentarian. Iraq’s government has pledged to award the contract before the end of 2015.

But in a sign of how cash-strapped the government has become, Iraqi lawmakers say they are now considering paying Baghdad’s fees to major international oil companies in oil rather than cash.

—Ghassan Adnan and Ali A. Nabhan in Baghdad and Kevin Baxter in London contributed to this article.

Source: The Wall Street Journal. Updated Sept. 15, 2015

http://www.wsj.com/articles/stalled-oil-field-project-adds-to-iraqs-woes-1442320290

Comment here