HIGHLIGHTS

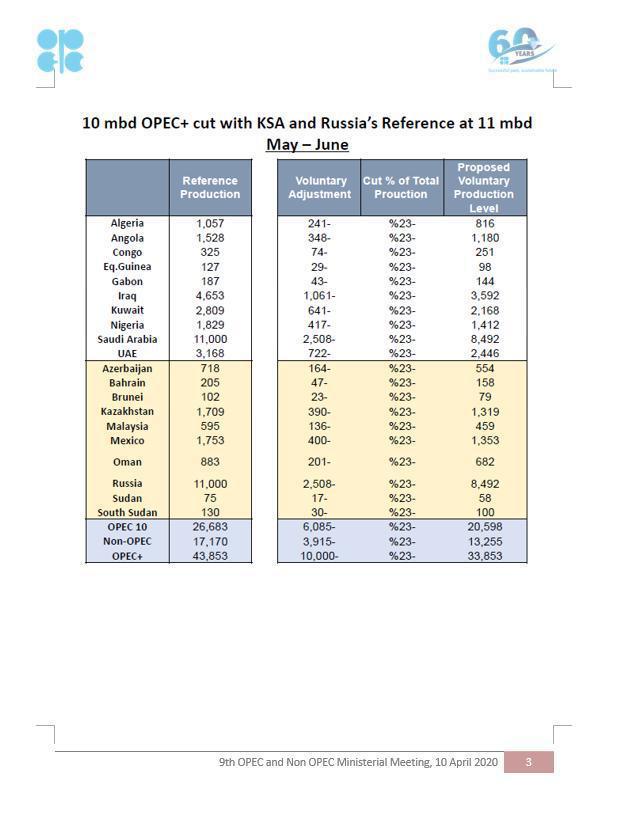

Iraq’s agreed cut is 1.061 mil b/d

First cuts seen at state-run fields

High-value crudes to take priority in output

Dubai — Iraq will have to cut production from fields operated by international oil companies to comply with the new OPEC+ pact, but the country’s 1.061 million b/d output reduction in May and June will test its contractual obligations with those companies including ExxonMobil and BP, analysts said.

OPEC’s second-largest oil producer is likely to start cutting output from the smaller, government-operated fields and then move on to IOC ones, most of which are in the south and are among the biggest fields in the country.

“Iraq’s compliance target – just over 1m b/d – is unlikely to be met for a number of reasons: cuts to IOC-operated fields such as BP’s Rumaila would mean Iraq paying hefty fees for lost production,” Ahmed Mehdi, a research associate at the Oxford Institute for Energy Studies, said. “OPEC-mandated cuts made by Iraq are likely to amount to a maximum of 400,000 b/d, primarily from state-operated fields such as Luhais, Tuba, and Nahr Bin Omar as well as some volumes from Kirkuk and Qayarrah.”

IOCs that operate fields include ExxonMobil at West Qurna 1, BP/China National Petroleum at Rumaila, Lukoil at West Qurna 2, and ENI at Zubair. Under complex technical service contracts, the IOCs are paid quarterly a fixed fee per barrel that is linked to production.

“Initially it will cut state-operated fields Majnoon, Subba, Luhais, Tuba, but that is only a small part of 1.061 million b/d,” Robin Mills, CEO of Dubai-based Qamar Energy, said. “I assume after that, that cuts will be distributed more or less evenly across the IOC fields. Iraq may also be liable to pay remuneration for oil not produced.”

High-value crude

Rumaila pumps some 1.5 million b/d, or nearly a third of Iraq’s daily oil output. Iraq pumped around 4.5 million b/d of crude in March and has a production capacity of about 5 million b/d, Assem Jihad, spokesman for the oil ministry, said earlier this month.

Iraq produced 4.65 million b/d in March, above its 4.46 million b/d quota under the OPEC+ agreement that expired last month, according to the latest S&P Global Platts OPEC survey. Last year, Iraq failed to comply with the OPEC+ cuts in most months as it overproduced to boost revenue from the oil sector, which accounts for 90% of state revenue.

The oil ministry may prioritize producing high-value crude that rakes in most revenue.

“There is an act of fine-tuning they need to do here by cutting less valuable crudes such as heavy Qayarah and so on and prioritize the higher priced light crudes,” Ruba Husari, an Iraq consultant, said. “This also includes prioritizing markets that bring in the highest revenues.”

Capex cuts

Iraq’s Basra Oil Co. has asked IOCs in the south to reduce their budgets by 30% and defer payments to them to cope with low oil prices.

“There will probably be a meeting of minds with what the ministry needs to achieve and what certain IOCs need to achieve (in terms of capex reductions),” Niamh McBurney, head of Middle East and North Africa at Verisk Maplecroft, said.

Most IOCs working on Iraq’s big fields have announced capex cuts due to lower oil demand following the outbreak of the coronavirus.

BP, for example, is cutting its planned capital expenditure this year by around 25% from previous guidance to $12 billion, targeting reductions in spending on exploration and major projects, with some output reduction expected, CEO Bernard Looney said earlier this month

Iraq is also insisting this time that the semi-autonomous Kurdish region contribute to the cuts, an act that is likely to be met with resistance from the Kurdistan Regional Government, which has sparred with Baghdad over oil sales and distribution of oil revenue.

Gas demand

Iraq will also need to keep production high because it relies on associated gas from the oil fields as feedstock to its power stations.

“A cut of this proportion would adversely impact Iraq’s associated gas production, required for power generation, particularly as we approach peak seasonal power demand in the coming months,” Mehdi said.

However, Iraq may have to cut its output involuntarily due to difficulties in marketing its crude, as was the case in April when state oil marketer SOMO struggled to sell crude to India.

“Output is already down in recent weeks due to refineries and power plants reducing operations as a result of the reduced activity during lockdown,” Husari said. “SOMO already struggled to offload some of their term contracts cargos for April and it’s going to be an uphill effort to market the full list in May. So they have no choice but to go with their announced quota for the next couple of months and hope for the best.”

Source: S & P Global Platts, 19 April 2020

Comment here