HIGHLIGHTS

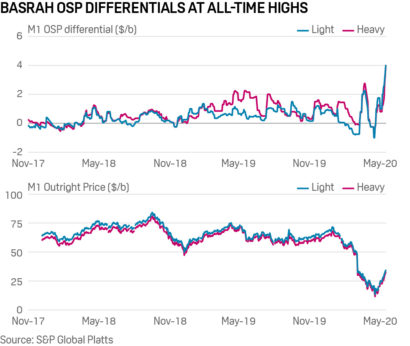

M1 Basrah Light & Heavy crudes assessed at premiums of $4/b

Strength seen in spot market for Basrah grades

Singapore — Price differentials for June loading cargoes of Iraq’s Basrah crude heading to Asia rose to a record high Tuesday, boosted by firm Chinese demand, cheaper underlying crude benchmarks and OPEC+ supply cuts.

The OSP differentials for June loading, M1 Basrah Light and M1 Basrah Heavy crudes were assessed at premiums of $4/b on May 19, S&P Global Platts data showed.

These are the highest assessments for both Basrah Light and Heavy crude grades since Platts began publishing price differentials for the Iraqi crudes in November 2017, records showed.

The assessments reflected recent strength in spot market activity for the grades, particularly cargoes flowing into China, where the crude is one of the grades deliverable into the INE’s Shanghai crude futures contract.

The most recent spot market trades depicted that Phillips 66 may have sold 2 million barrels of Light and Heavy crudes to Chinese refiners at premiums ranging from $4.50/b to $4.70/b, market participants told Platts on May 19.

Earlier in the month, at least 3 million barrels of Basrah Light changed hands at premiums ranging from $2/b to $3/b. At least two of the three cargoes sold then were understood to be headed to Asia, most likely China, said market participants.

Over March and April, Basrah crude cargoes also fetched firm premiums on the back of unrelenting demand from China, despite most other Middle East sour crudes seeing their spot rates dive into deep discounts.

For instance, a May loading cargo of Basrah Light fetched premiums of around $3/b mid-April, at the same time when Abu Dhabi’s light sour Murban crude was trading at discounts of around $2/b to its OSP.

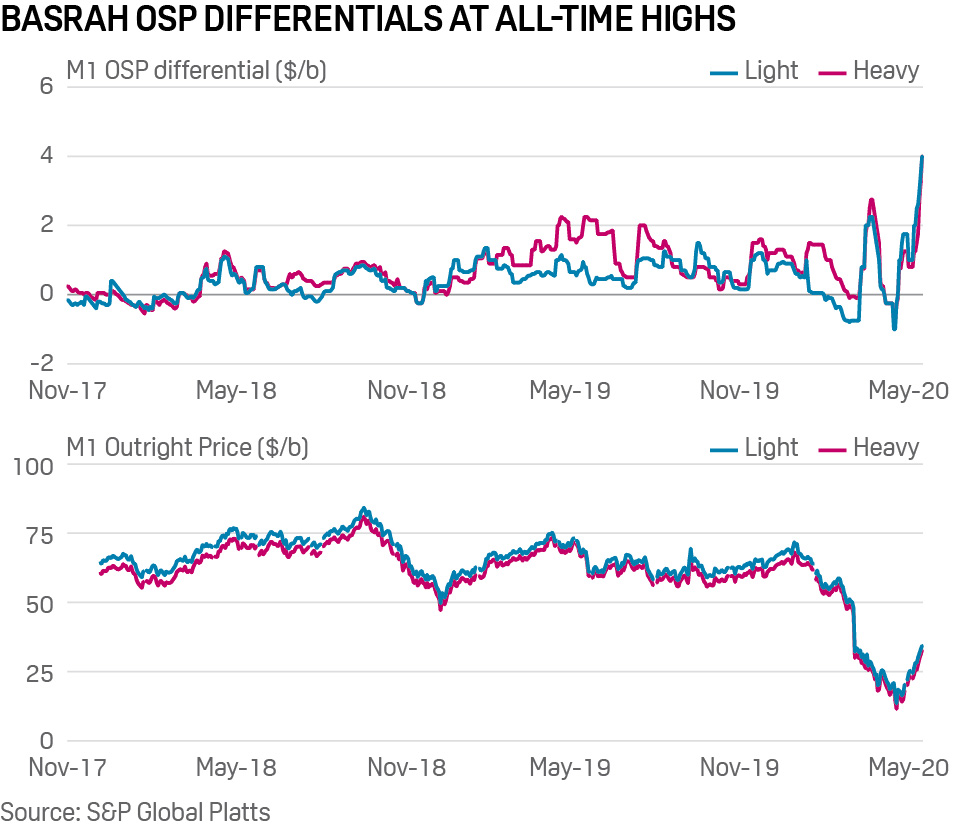

Even with spot cargoes fetching premiums over the official selling price, the final prices for these cargoes still work out to a net discount against the underlying benchmarks, according to Platts data.

The underlying OSP for Basrah crudes is perceived as relatively cheap by buyers in China, due to a combination of OSP cuts and low global oil prices, said traders of the grade in Asia.

Additionally, shorter supply of alternative medium and heavy sour grades in Europe, and availability of storage in China are some of the reasons why the Basrah cargoes continue to fetch high premiums amid a period of muted global crude demand, they added.

In recent weeks, buyers in China have taken advantage of low crude oil prices in the global market, while being guaranteed a floor price for its oil products domestically. China has a firm floor set for domestic oil product prices at $40/b as part of government measures to support the domestic refining industry.

Strength in the price of Shanghai crude oil futures hosted on the Shanghai International Energy Exchange, or INE, and a doubling of storage capacity may also help explain the generous premiums paid for Basrah crudes by Chinese buyers, said market participants.

According to one Beijing-based analyst, this expanded capacity together with SC’s premium against Middle East crudes would give more opportunity for physical players to bring cargoes onto warrant. According to INE data, the volume of crude held on warrant has already reached an all-time high, more than double to 8.2 million barrels on April 28, up from 3.4 million barrels at the beginning of the month.

More than 10 million barrels of Basrah Light and 4.4 million barrels of Oman have been bought onto warrant since the contract started trading in March 2018, the exchange data showed.

Source: S & P Global, 20 May, 2020

Comment here