Baghdad: Al Furat News. The economic advisor in the cabinet, Dr. Madhar Muhammad Salih, proposed a set of solutions aimed at confronting the fiscal deficit in the next year 2021 budget, which was initially estimated at approximately 35 trillion dinars, putting at the forefront of these proposals, financing the deficit gap through Improvement in oil revenues and positive deve

Read MoreAbstract In 1979 Iraq was a net creditor to the world, due to its large oil reserves and lack of external debt. Fifteen years later, its government debt-to-GDP was over 1,000%. At the time of the U.S. invasion in 2003, Iraq was saddled with around $130 billion in external debt that needed to be restructured. How does a country incur so much debt, so fast, and how does it ge

Read More1. Introduction [1] The purpose of this note is to shed light, and comment, on two views expressed recently in relation to the appreciation of the Iraq Dinar (IQD) in 2006-2008. Muhammad Tawfiq Alawi (henceforth M. Alawi), former minister of communications in Iraq, gave a talk on December 13, 2019 in Washington D.C. to an Iraqi audience, in which he

Read MoreAbstract The article addresses the subject through four topics: the first topic offers an empirical examination of the performance of the banking sector during the period 2010–15. It also diagnoses the sector’s weaknesses and attributes such weaknesses to their inherited causes, be it legal, environmental, managerial or regulatory issues of the banking industry. The analysis

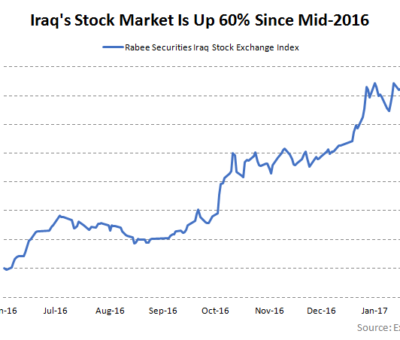

Read MoreAFC is overweight on Iraq’s financial stocks Hong Kong-based fund management company Asia Frontier Capital (AFC) has been actively tracking Iraqi equities since June 2015 when they launched the AFC Iraq Fund. As of January 2017, the fund is overweight the financial sector which commands a good 58.1% portfolio allocation. Consumer staples stand second with a 23.3% weighting.

Read More