Dr Ali Merza’s excellent paper on the “The First Round of Licencing in Iraq: Economic Evaluation” ** has tempted me to write this short article as complementary knowledge to bring about the bigger picture to decision makers when fully evaluating the the next round of the Oil contracts.

Although economic evaluation is critical to the decision making process, it does not on its own provide the holistic picture where success or failure, of such contracts, could be attributed to. (Success or failure is measured by whether or not the contracts’ targets (in mbd) are met, i.e. generating the “expected” revenue for Iraq). The past six years have clearly shown that the IOCs have partially/completely failed to meet the predicted production targets irrespective of the economic validity of the contracts. This is mainly attributed to two other critical factors; a) the capability and capacity of the Iraqi oil institutions to manage these contracts (Management factor) and b) the transparency and corruption within these institutions (Politics factor). This paper briefly explains these two factors as a complementary measure and the role they play in the success or failure of large contracts.

The first figure bellow the right shows the interrelationship between the three factors; Economics, Management and Politics along with the interface between them.

Management

This is a reflection of a) the capability (availability of skills) within the Iraqi oil institutions to manage/administrate the interface between the IOCs and the Iraqi “back-office processes” and b) the capacity (experience/practices) to provide high quality and fast service to the main contractors (IOCs). The lack of high quality Management can significantly hinder the performance of the main contractors and lead to costly delays.

Politics

This is a reflection of the level of transparency and corruption within the Iraqi oil institutions which can “make or break” a healthy work environment between them and the IOCs. The higher the corruption level, the lower is the transparency, hence the ability to create strong client leadership to drive those contracts forward will be significantly weakened.

No country, particularly in the developing world, has reached perfection. But, in general, they have managed to arrive to balanced solutions to first ensure “maximum oil production with controlled production costs” and secondly ensure that they have the time to build up the capability and capacity of their national institutions for long-term gain (through effectively scheduled technology transfer program).

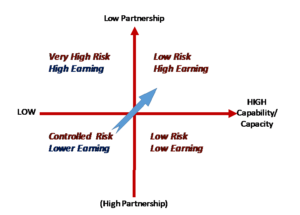

The second figure bellow shows the distribution of Risk (of not achieving the contracted production targets) versus Earning (the “expected” income from oil production). The vertical axis represents the percentage of partnership with the IOCs (assuming it is low with SC and high with PSA). The horizontal axis represents the capability and capacity of the Iraqi oil institutions, as explained earlier.

High Earning (low partnership) with High Capacity

The best scenario is the top right quartile, where organisations can generate high Earnings when they have high capability and capacity to effectively manage the performance of the main contractor. This situation is typically led by a well negotiated SC. In this context, the Risk of successfully delivering the contracts is Low and the “Expected Earning” is high.

High Earning (low partnership) with Low Capacity

The worst scenario is the top left quartile, where organisations sign a low partnership contract with the main contractor and at the same time have low capability and capacity to manage the performance of the contractor. This is to say “placing the main contractor on the driving seat and hoping that they will take the client to the agreed destination!”.

Lower Earning (higher partnership) with High Capacity

A bad scenario is the lower right quartile, where organisations have high capability and capacity to manage the contractor’s performance but sign a high partnership agreement with them. This will unnecessarily reduce revenue and most likely will create resentment within organisations.

Lower Earning (higher partnership) with Low Capacity

A good scenario to be in is the bottom left quartile, where organisations can generate “Lower Earning” while having very Low internal capability and capacity to manage the main contractor’s performance, i.e. organisations suffer from bureaucracy and lack of transparency. With higher partnership with the main contractor, the risk of achieving the contract targets will be much more controlled as any costly delays in delivering the contract will significantly harm the main contractor too. Under this scenario, organisations can sign a clearly defined long-term agreement with the main contractor to undertake a) effective technology transfer program to improve the performance of the national institutions and b) have a better influence on the main contractor’s ability to contribute to the wellbeing of the local society through their Corporate Social Responsibilities (CSR). Finally, organisations in this quartile aspire to move to the top right quartile scenario after developing high capability and capacity to run future contracts.

(*)Professor Alshawi is a Professor of Management and IT in Construction and the Director of Unisearch Ltd (UK) and IEC (UAE). He is also the Director of the Institute of Sustainability and BIM (UAE).

(**) Republished on the website of the Iraqi Economists Network

http://iraqieconomists.net/en/the-first-round-of-licensing-in-iraq-economic-evaluation-dr-ali-merza/

Copyright Iraqi Economists Network, Ja

Test 10.01.2016

—–Original Message—–

From: Husain Al-Chalabi

To: info

Sent: Fri, 8 Jan 2016 0:17

Subject: Comments by Dr Husain Al-Chalabi on “Iraqi Oil Contracts: The complementary factors of Management and Politics. By Professor Mustafa Alshawi *

Dear Professor Mustafa,

Greetings

I read with great interest your write up on “ Iraq Oil Contracts :- The Complementary factors of Management & Politics” . I like your analysis ; but must admit that it does not apply to the oil sector if my premise is correct that Iraq’s objective from signing the service agreements for the increased oil production is to secure significant increase in revenue [ price x volume ] .

With my experience in negotiations of contracts in the energy sector [ not for the upstream ], I learnt that you have to be clear in what you want to achieve and seek partners / providers that can deliver quality work on time and within budget.

To me , a Prudent negotiator for a long lasting relationship cover the following points:-

– Objective is to :- DOT the I’s and CROSS the T’s.

– where elements are subject to change – to identify a concept of how to accommodate .

– the negotiated agreement is reached when the dialogue gap [ linguistic, professional and cultural ] between parties is bridged.

– The agreement becomes the practical document to draw the road map for the working relationship and project implementation. [ Turning the paper Agreement into a project with physical application and human interaction ]

– The project [ physical resource extraction ; Human resource development for sustainable operation ] follows the S.M.A.R.T concept [ Specific , Measurable , Achievable, Realistic and Time based ], with the necessary details listed when there is uncertainty with guidance to solutions .

– Walk the Talk covers :- organisation and management of skills ; technology ; equipment ; human interaction ; stake holders satisfaction

Since the signing of the Iraqi Service contracts, I have not commented on the contracts because I was not able to have access and study a signed copy with its appendices. Personally , I do not like to “judge the book by its cover”. If you have read any of the signed agreements, please check whether the strategy of Iraq was to maximise the barrels or the revenue. If it is the barrels, then we can deliberate the issues raised in your write up.

Let me identify below what I expect Iraq wants & what IOC want in such contract:-

Iraq

Iraq’s main desire to enter into the service contracts was to maximise revenue [ Price x Volume ] at minimum expenditure [ i.e. benefiting from state of the art technology ]. This implies that the strategy is to make available to the market reasonable volumes that does not negatively impact the price of oil – ideally the incremental production is not much more than the increased demand . Seasoned oil men , not necessarily experts, have witnessed the magnitude of change in oil price when there is small excess [ less than 1 million barrels per day ] . Such event happened in the 80s & 90s and we are seeing it now. The price is very sensitive to shortages or surpluses. We voiced our views on the market issues when the contractual volumes [ increase of production about 9-10 million barrels per day ] are introduced over a period of 5-7 years.

IOCs

IOCs are compensated by a bonus based on achieving contractual increased production in a scheduled fashion . Added to that are the benefits included in the cost recovery . It is to be noted that the IOCs , with the erosion of their in house capabilities in recent years, became mainly financiers and managing their subcontractors. Hence, one can say the IOCs interest in the execution of the contract is the increased volumes and the rewards from the expenditure to achieve the increase .

What I understand , which needs to be validated , is that even with the revision of the contracts to reduce the peak production & optimise the life cycle production from the reservoir, the built in production capacity exceeds the current production [ there is redundant capacity paid for ; but not utilised ]. This is due to the limitations of the infrastructure to take the oil from the fields to the market.

I cited in my presentation at the CWC – Iraq Petroleum 2012 an article in the O&G Journal [ May 2 , 2011 ] by Energy Policy Research Foundation – Is Iraq a game changer for the US ? “ If Iraqi output shifts the long term price of oil from any number of the base-case forecasts by 20$/Bbl – e.g 100$/Bbl to 80$/Bbl , it would yield a present value in import costs to the US economy of over $1 trillion” . Accompanying this saving would be substantial improvement in growth and expansion of the US economy . In this respect , Iraq is a game changer .

Before we rush to conclude whether the contracts have been a success or a failure, let us seek the truth as to what the Iraqi negotiators have signed.

Please review my comments and let me know if you can get better insight into the agreements.

Best regards

Husain Al-Chalabi [ FEI ]

Dear Dr. Al-Chalbi

Thank you for posting your valuable comment. You are wellcome to write for our Network on the same subject.