Foreign Investment: The Non-oil Revenue Source Iraq Needs to Ensure a Vibrant and Sustainable Economy . BY BASTA SIRWAN*

Executive Summary:

For Iraq, Foreign Direct Investment (FDI) could be the answer to fiscal improvements and increasing foreign currency reserve in the market. Global demand for oil export is expected to continue, thus exploiting high energy prices to minimize budgetary deficits needs to become a priority. Increasing current expenditures along with rising oil prices is a shortsighted plan for a country that is highly dependent on oil exports for its revenues and thus exposed to macroeconomic volatilities. The Iraqi constitution allows for attracting foreign investment; exemption from taxes, ownership of real estate, transferring funds to outside, are some of the ways to encourage foreign investment. However, Iraq still must put these incentives into practice to follow the example of other OPEC countries in attracting FDI.

Key Question

What are the Foreign Investment obstacles in Iraq, why is Iraq not attracting more foreign investment?

Introduction

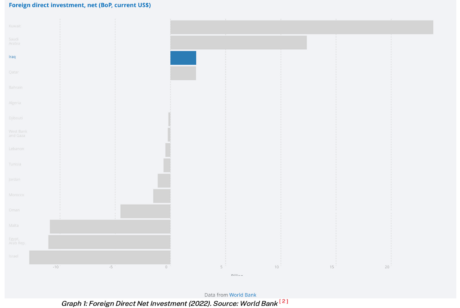

Foreign Direct Investment (FDI) is one of the attributes of modern societies created by globalization. The term merely means ownership stake of foreign businesses. Foreign Direct Investment (FDI) can be in the form of outright buying a business, opening new branches for business operations expansion, or investing in existing projects in the economy. This type of investment is the doorway for knowledge transfer because it includes not only capital transfer, but management, skills, and technology transfer to the receiving economy. Therefore, FDI creates employment opportunities, improves workforce skills, and drives economic growth.1 Money flowing from one country to another can be described as in-flow or out-flow. Most recent data on foreign direct investment from the World Bank shows the net FDI in Iraq as $2.33 billion in 2022. Whilst other OPEC countries such as Saudi Arabia and Kuwait had $12.5 billion and $23.8 billion in FDI respectively.

Graph 1: Foreign Direct Net Investment (2022). Source: World Bank 2

Leveraging Oil Revenue to Attract Foreign Investment

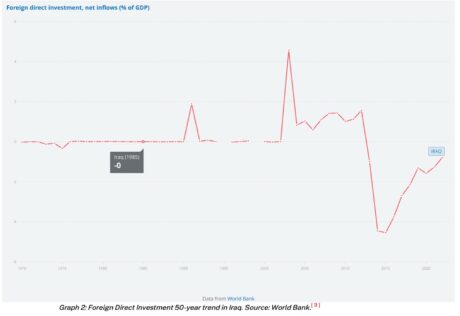

Countries such as Kuwait and Saudi Arabia leveraged their oil revenue to attract foreign investment and strengthen their economy. Why isn’t Iraq able to do the same? There are many reasons. It has been nearly two decades since the United States invasion of Iraq. Since then, the country has gone through several economic booms and turmoil created by its political scene, geolocation, internal misalignments, socio-economic crisis, global pandemic and terrorism. For example, between 2000-2010 FDI has seen a positive in flow indicating a healthier economy compared to 2014 and onward, which was the mark of ISIS and the global pandemic.

Graph 2: Foreign Direct Investment 50-year trend in Iraq. Source: World Bank.3

It is important despite everything to sustain a positive mindset towards the future. Iraq does not lack resources nor monetary capabilities. Globally oil is still a well sought-after commodity; it is used domestically and globally and is the main ingredient for many other industrial products. Therefore, a substantial amount of oil revenue can still be anticipated for Iraq in the future. When the financial institutions are digitized, and therefore the government’s public wage is revised, money laundering is controlled, trade and fiscal policies are better formulated and corruption is minimized, the oil exports revenue will become a commodity to attract more revenue sources such as FDI. A well-regulated and transparent environment will encourage foreign investment in Iraqi businesses.

Revenue Excerpt from the Iraqi Federal Budget

Iraq’s economy has a high dependency on crude oil and petroleum products exports. As of 2023, the Iraqi federal budget sets crude oil exports revenue as $89.425 billion and petroleum products export revenues as $769 million. Collectively, this accounts for 87.14% of the total federal budget revenue which is $103.502 billion. 4

In March 2024, the Iraqi market witnessed a spike in crude oil prices soaring to $84.7 per barrel because Saudi Arabia cut 2.2 million barrels of oil exports which affected its demand supply in the global market. 5For a country that produces 4.2 million barrels per day and is a member of OPEC, this should translate to a substantial revenue boost. 6 In practice it is not happening due to the semi-static nature of Iraq’s Federal Budget and its policies that does not respond to reality of Iraq in a timely matter. For example, the Iraqi federal budget was not released on time to be effective for 2022. In 2023, the International Chamber of Commerce (ICC) ruling paused 400,000 barrels per day of crude oil exports from Iraqi Kurdistan Region (KRI) through Iraq-Turkish pipeline. Additionally, crude oil exports through the North Oil Company (NOC) were also paused by a volume of 90,000 barrels in the first quarter of 2023. Even though these oil export suspensions happened in the first quarter of 2023, and the budget was approved in June, the fiscal policies did not reflect these changes. 7

Untapped Potential in the Iraqi Market

Iraq could have a competitive advantage in attracting foreign investment for two reasons. First, Iraqi market has potential for growth because of the existence of unmet demands coupled with opportunities to meet those demands. Agricultural productions of dates in the south and central and pomegranate in the north, are such opportunities waiting to be invested in through exporting their products to the global market. These markets have the potential of attracting foreign investment. Second, the irreplaceable oil demand in the world, and Iraq being the second largest oil producer of OPEC can one day open doors for a fast-growing economy and emerging market. Given institutional digitization, such as digitizing the banking system and national and international investments, Iraq’s emerging markets can support domestic demands and exports.

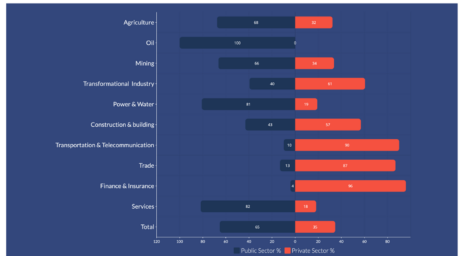

Chart 1: Public and private sector contribution to the formation of fixed capital in 2018. Source: National Investment Commission, Investor Guide to Iraq 2023.

Benefits for Foreign Investors

The Iraqi constitution have specific indicators that is in support of attracting foreign investment. The following are a list of some of these laws dictated in the Iraqi constitution:

- Per Iraqi constitution, foreign investors are exempted from taxes for the duration of the first 10 years.

- Foreign workforces are encouraged and permitted to work on these foreign projects.

- Foreign investors and workers have the right of residency in Iraq.

- Foreign employees have the right of transfer of salary and funds to outside of Iraq with the condition of having no outstanding debts due to the Iraqi government and other entities. 8

- Foreigners are also allowed to buy real estate given that they have been residing in Iraq for seven years. 9

Although constitutional support for FDI is present in Iraq, Iraq still needs to enhance its global market competitiveness to win over foreign investors. The health of the country and its development affect the degree of competitiveness and therefore, investors’ psychology. If domestic economy prospects are positive in terms of size, growth, wealth and future forecasts, investors take it as a sign of healthy economy to invest in. The labor market skills, costs, attitude, relations also affect investors decision. Central bank and state efficiency opens doors for business finances to be open, competitive and well-regulated, which boosts trust and lowers loss aversion for the investors.

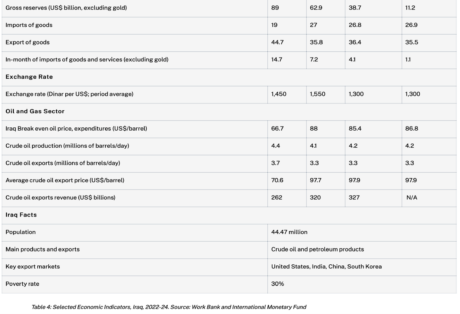

Economic performance is measured by calculated indicators. For example, real GDP is the measure of actual growth of an economy (without the effects of inflation). Real oil GDP growth decreased by –4.4% in 2023. This is an indication of economic growth due to oil production decreased which can be related to the fact that Turkey-KRI pipelines paused 400,000 barrels of crude oil export per day. Another example for the same year, the central bank and the government’s actions aiming to digitize the banking system affected the exchange rate of Dinar vs Dollar. Consequently, consumer price inflations increased as an indication that business needed to add extra price margins to make up for the devaluation of Iraqi Dinar. As indicated in the table below, the economic indicators give an overview of economic performance, government efficiency and businesses efficiency.

Burning Oil Money is a Short-Term Plan

International Monetary Fund’s recommendation for Iraq in March of 2024 is to limit its dependency on oil and to diversify its sources of revenue. 10 The initial step towards achieving that is formulating policies that generate non-oil revenues. According to the Iraqi White Page’s statistics released in 2020, Iraq’s government spending has a 60% direct correlation to oil revenues. 11 This entails that Iraq’s policies for making best use of any increase in oil revenues is spending it. One could argue that Iraq’s infrastructure and economy needs the injection of more revenue from the state, however, this is a short-sighted plan to solve an issue that needs more long-term strategy.

Along with the formulation of better policies targeting economical and commercial areas, Iraq will benefit greatly from joining international bodies for improving its access to foreign funds and global trade. In the 13th Ministerial Conference of World Trade Organization (WTO) in Abu Dhabi, March 2024, the Iraqi Trade Minister mentioned that Iraq has prepared all the required documents for Iraq to transition from an observer to a full member in the WTO. The initial intention of joining the WTO started in 2004. 12 In a case where the membership is approved, Iraq will have the access to the global market to better align financial policies with international standards. Joining the World Trade Organization would increase Iraq’s attractiveness to FDI because loss aversion would minimize investment in the economy.

Factors Negatively Affecting Foreign Direct Investment in Iraq

Attracting Foreign investment needs to become one of the primary focuses of government-led policies. The following is an analysis of the reasons Iraq is not attracting more foreign direct investment:

- Market entry and business operation restrictions: bank policies that restrict big amounts of cash flow.

- Asset management restrictions: getting credit, lack of transparency and predictability.

- Weak regulatory and legal infrastructure: enforcing contracts, openness in legal and regulatory regimes.

Businesses Centered Obstacles

There are key points in business operations in Iraq that discourage foreign investors from investing in Iraq. The following is a list of those key points:

- Lack of transparent and clear transactions between businesses and investors. Investors need to be able to monitor and understand the records and be able to assess the health of the business through their financial statements. Therefore, businesses need to use banks and have a clear and transparent record of their financial statements backed by records and statements from the bank. For quote: One example of commercial bank in Iraq that provides loans for medium size enterprises is Iraqi Middle Market Development Fund (IMMDF). The small and medium-sized businesses have bank accounts with the fund and based on the performance of their financial statements, IMMDF lends monetary support with interest rates.

- Revenue allocation by businesses needs to be directly from sales and better if the sales are from diverse sources (new technology, services, products). Businesses that depend on a single profitable customer or get funds from one investor are not likely to attract foreign investment. Businesses providing solutions that fit diverse range of demographics are reducing risk of business dissolution and attract foreign investors.

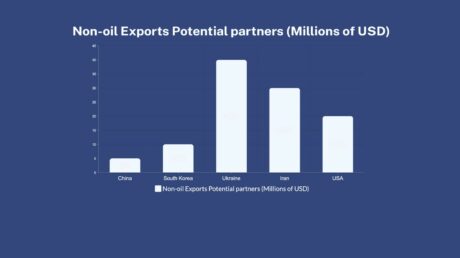

- Catching global market share through active advertising campaigns targeting foreign businesses and consumers introduces Iraqi market to the global market which in turn increase Iraq’s visibility to foreign investors. Iraqi non-oil exports are only 10% on average annually. This means that Iraqi domestic market does not have a large flow to the global market.

- Business propositions need to evolve over time clearly showing interest and demand for their solutions. There must be a proven potential for the number of businesses to increase when investment is requested. Business innovations and adoption of technology increase the business value proposition.

Central Bank Imposed Centered Obstacles

The central bank policies and strategies aimed to slow down the escape of the dollars to foreign countries imposed on small and medium businesses, stagnates efforts by local investors to expand their business operations. The following are a few obstacles imposed by the central bank:

- Businesses are forced to pay and receive payment in Iraqi Dinar. This creates price inflation for businesses that purchase their supplies in other currencies such as the US dollar because of the fluctuation in US dollar versus Iraqi Dinar exchange rate. In some cases, for the business to break even, they create their own currency exchange rates which are charged to the customer. This unique exchange rate would allow a price cushion for the business in case of devaluation of Iraqi Dinar. Consequently, this price uncertainty directly affects the purchasing power of customers and therefore affects sales. This inflation in prices directs consumer behavior to purchase less because of loss aversion created by this situation itself.

- Central bank limits Iraqi Dinar and foreign currency exchange transactions. This forces businesses to rely on both cash payments and bank payments in case they need to purchase supplies from the outside.

Government Imposed Obstacles: Purchasing Power and Oil Exports Nexus in Iraq

Iraq has a workforce of 8.5 million employees and nearly 71% of them depend on state salaries, that is 6 million employees. Hence, the crude oil and petroleum exports directly affect the purchasing power of the market. Any halt in the exports volume and price fluctuation would compromise the government employees’ salaries, therefore, their purchasing power. Consequently, weakening the private sector (directly & indirectly). According to the World Bank, in 2020, 77% of total Iraqi government spending are non-discretionary expenditures. Public wages and pensions account for a large portion of this expenditure. Nearly 27% of GDP (Gross Domestic Product, or economic activity) came from this expenditure which is the largest public wage bill in the world. In June 2023, the Iraqi government added nearly 600,000 new positions. The Internationally Monetary Fund commented on this stating that this addition was going to contribute to monetary deficits. In order for Iraq to break-even, crude oil had to be sold for $96 per barrel. Iraqi crude oil in May 2023 was sold for $71 per barrel. 13

Comparison

Iraq and Saudi Arabia are oil producing countries and their exports are largely composed of crude oil and petroleum products. For the duration of 11 years, Saudi Arabia’s government managed to raise Foreign Direct Investment from $5 billion in 2011 to $33 billion in 2022. 14 This increase was because of allocation of a portion of Saudi Arabia’s national budget to rebuilding the infrastructure, economy and diversifying sources of income. Saudi’s government also set a target of reaching $100 billion in FDI by 2030, which would create a boom in Saudi Arabia’s economy even if half of that target is reached. The country leveraged their oil revenue to conduct substantial reforms in legal, economic and social sectors to attract more FDI. The government started many initiatives such as National Investment Strategy, tax incentives, zero levies for foreign companies in addition to the state creating four new economic zones. 15

Key Takeaways

If the government and Iraqi Central Bank join forces to create policies that lessen the extreme financial burden on businesses, the private sector becomes more resilient towards the political and economic challenges that face the country, and as a result will attract more foreign investment. There is a lesson to be learned from other OPEC countries such as Saudi Arabia. Iraq’s oil revenue is substantial and comparable to Saudi Arabia’s. What Iraq lack are policies and regulations that direct the flow of capital towards rebuilding the infrastructure and diversifying and strengthening its economy. Iraq needs intelligent fiscal policy formulations by the federal government and central bank; policies that protect the interest of businesses, create a business-oriented environment and to enhance trade and the private sector generated revenues. It is only then Iraq can attract more foreign direct investments.

- Hayes, Adam. “Direct Foreign Investment (FDI): What It Is, Types, and Examples.” Investopedia, March 27, 2023. Read More↩︎

- United Nations Conference on Trade and Development. “World Bank Open Data.” World Bank Open Data. Accessed March 16, 2024. Read More↩︎

- Please refer to reference no. 2 ↩︎

- Iraq Business News | All the latest business news from Iraq. “Jiyad: Iraq Oil Exports 2023 – Budget vs. Realities | Iraq Business News,” February 6, 2024. Read More↩︎

- “OPEC Basket Price.” Organization of Petroleum Exporting Countries, March 14, 2024. Read More↩︎

- S. Energy Information Administration. “Iraq’s Energy Overview,” 2024. Read More↩︎

- Please refer to reference no.4 ↩︎

- ALSAIF Law Firm. “Investment in Iraq / Foreign Investment Law in Iraq – Foreign Investment Law in Iraq – ALSAIF Law Firm,” February 14, 2021. Read More↩︎

- “USAID Iraq Local Governance Program Land Registration and Property Rights in Iraq.” Humanitarian Library, January 2005. Read More↩︎

- Salem, Amr. “IMF Advises Iraq to Reduce Dependence on Oil.” Iraqi News, March 3, 2024. Read More↩︎

- Iraqi Business News. “White Paper-Final Report, Emergency Cell for Financial Reforms,” October 2020. Read More ↩︎

- Corporate-news – Gulf News. “Iraq Confirms It Has Completed the Requirements to Join WTO,” March 5, 2024. Read More↩︎

- World Bank. “INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT INTERNATIONAL FINANCE CORPORATION MULTILATERAL INVESTMENT GUARANTEE AGENCY COUNTRY PARTNERSHIP FRAMEWORK FOR THE REPUBLIC OF IRAQ.” World Bank, July 12, 2021. Read More↩︎

- Please refer to reference no. 1 ↩︎

- Please refer to reference no. 1 ↩︎

The Articl is published first by https://innov8.channel8.com/1029

*Basta Sirwan is a Research Specialist at the iNNOV8 Research Center. Her research areas include Entrepreneurship, Innovation, Finance and Economy. At the center of iNNOV8 research initiatives, Basta has specialized focus on investment, financial analysis, stock analysis, venture capitalism, entrepreneurial finance, social entrepreneurship, civic engagement and climate change.

Source: iNNOV8 Research Center

https://innov8.channel8.com/1029

Comment here