The news from Iraq is not always depressing, though after further scrutiny one becomes apprehensive.

A few days ago, the Ministry of Industry (MoI) signed an “in principle” agreement with Royal Dutch Shell to build a petrochemical plant at an estimated cost of $11 billion (Dh40.4 billion) in the Basra region. The plant should be operational in five years, as reported by news agencies.

Details of the deal are not yet known as only the heads of agreement have been signed. But it is to produce “plastics, fertilisers and other petroleum derivatives that will help diversify Iraq’s economy”.

Iraq has only a small plastics producing petrochemical plant of not more than 120,000 tonnes a year which started operations in the early 1980s, but is said to be in need of major maintenance and renovation. Currently it may be partly operational at best for lack of natural gas feed.

The second petrochemical plant is a small 50,000 tonnes a year facility to produce chemical detergents and is a joint venture between Iraq, Saudi Arabia, Kuwait and some Arab investment companies. It is located in Baiji and depends on its feed from the next door refinery, which unfortunately has been in a war zone since June. No one knows exactly what the status of the plant is.

The fertiliser industry is over 40 years old with three plants producing ammonia and urea to the tune of 3,500 tonnes a day of ammonia and almost 5,000 tonnes of urea. The plants are in the Basra region and said to be in need of a major rehabilitation and could be in partial operation for lack of gas feed. The other plant is in the war zone north of Baiji and its current status is not known.

To complete the story, Iraq had planned and actually started construction of its second petrochemical plant, which was to be integrated with the Midland refinery near Baghdad. That plant was very complex and depended on gas and liquid feed to produce large quantities of petrochemicals.

But the project was cancelled in 2003 and the refinery section relocated to Karbala.

Therefore, at least on face value, the new Shell project if realised would be a great boost to Iraq’s troubled and modest petrochemical industry. Its overall capacity is reported to be 1.8 million tonnes a year of various products, a scale similar to the cancelled petrochemical project mentioned earlier.

However, the hype surrounding the announcement does make one wonder. The minister of industry Nasser Al Esawi told a press conference that the Nibras complex would make Iraq the largest petrochemical producer in the Middle East. Apparently no one advised him that Saudi Arabia produces more than 50 million tonnes a year of petrochemicals and it will be decades — and many large-scale projects — before Iraq can catch up.

Favourable terms

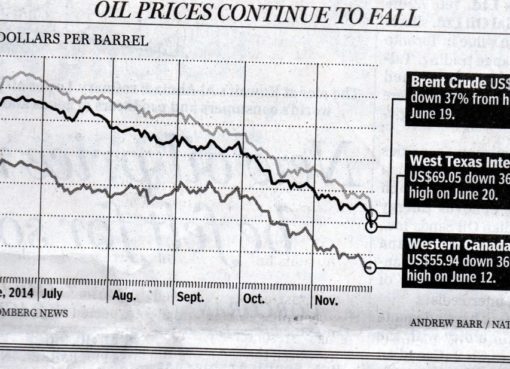

Questions are being asked; how come Shell agreed to a project of this magnitude just two weeks after it announced that it will not proceed with the proposed Al Karaana petrochemicals project in Qatar, which was much more advanced than the Iraqi project. The reason for the cancellation — or postponement — is said to be the economic environment in the wake of the precipitous decline of crude oil prices, which applies equally to Qatar and Iraq.

The question is — has Shell squeezed more favourable terms from Iraq in terms of feedstock cost and other economic parameters?

Shell has been discussing this project for a long time with Iraq, and a memorandum of understanding was signed in 2012. The Iraqi cabinet is said to have approved the project in January 2013.

Therefore, it took the parties just over two years to reach an agreement in principle and one would fear that a final agreement may take even longer at a time when Iraq needs to expedite its investment programme.

Because Shell is in charge of natural gas development in the south of Iraq, I presume that the feedstock for the petrochemical plant would be sourced from the gas processing facilities current and future, which means most probably the feed would be ethane, methane, LPG and natural gasoline. These are all products of gas processing and their further use will add value to the economics of gas utilisation.

There is no doubt that Shell with its technical, financial and engineering experience will be on top of any selected partners to develop the Iraqi petrochemical industry. But critics would ask the question why Shell alone and where is the competitive and transparent process required in a project of this size and cost?

The above are initial thoughts on this announcement and more discussion would be in order when more details emerge. The most important thing to realise is that time is of the essence.

(*) The writer is former head of the Energy Studies Department at the Opec Secretariat in Vienna.

Source: Gulf News, published: February 8, 2015

Comment here