Economic Forecasters

It’s often said that you can’t get economists to agree on anything. Well oil economists certainly can’t agree on future prices with commentators suggesting anything from $20 to $200. Seldom has there been such a discrepancy in forecasting though the median forecasts seem to be somewhere between $60 and $70. The reemergence of low prices and price instability after three years of stable prices and the rising number of supply and demand variables only serves to create uncertainty and obstacles to long-term capital investment.

Some commentators claim it’s only history repeating itself taking solace in Keynes’s view of commodity markets. “When prices rush up, uneconomic and excessive output is stimulated and the seeds are sown of a subsequent collapse. .. Assuredly nothing can be more inefficient than the present position where the price is always too high or too low and there are meaningless fluctuations in the plant and labor force employed.” Is it just the inefficiencies of a market adjustment of supply and demand or is the oil market facing structural change?

The End of OPEC’s High Price Collaboration?

Undoubtedly, the major fluctuations in prices have usually been beyond the control of Organization of the Petroleum Exporting Countries (OPEC) and the result of geopolitical conflicts, regional wars and speculative financial activity. OPEC has however let prices rise at the behest of high cost non-OPEC oil producers such as the USA leading to the development of expensive offshore oil fields such as the North Sea, Gulf of Mexico and Brazil. Expensive capital-intensive onshore fields like the tar sands and more recently the shale oil & gas fields have now come on stream recovering their capital set up costs and their break-even costs are now much lower. In fact, the costs of extraction for more favorable plays have come down significantly, and that there is some empirical evidence emerging that suggests that some unconventional gas can be produced at lower costs than conventional gas. For oil too, we have seen enormous variety in break-even costs, ranging in the Bakken from between 28 and 85 dollars a barrel. So this is not high cost per se. Meanwhile, low-cost Middle Eastern fields remain neglected and underdeveloped as high prices and increasing revenues have been sufficient to meet OPEC members’ fiscal requirements. In addition, the poor Middle East and North Africa (MENA) government decisions such as over generous consumer energy subsidies and the wastage of resources from gas flaring have only contributed to their failure to keep abreast of the growth in local demand leading them now to adopt dash for gas investment strategies rather than waste expensive oil to produce electricity.

Far from acting like a cartel OPEC has failed to maintain its market share by allowing self-defeating pricing and production policies to reduce its influence on the market. OPECs output has hardly changed over recent years producing between 29-to-31 million barrels a day (mbd) meanwhile non-OPEC countries and in particular the USA and Russia have significantly increased their output.

In recent years, many OPEC members have begun to invest in increasing their capacity to meet their rapidly growing home energy needs and also increasing their export potential. Iraq, where despite its troubles with Islamic State of Iraq and Syria (ISIS) militants, has increased its output significantly reaching 3.5mbd and is still investing in capacity. The UAE, Saudi Arabia and Kuwait have embarked on significant investment in building their production capacity to meet rising home energy demand and increase their export potential. If the Libyan conflict is resolved and with the removal of sanctions against Iran, the potential for OPEC to increase supply is growing and likely to grow further. Equally, turmoil can significantly hamper OPEC output. Though, the much vaunted return of Iranian oil onto world market if the sanctions are lifted is probably somewhat over stated at one million barrels a day as the US allowed exemptions to countries whose refineries were dependent upon Iranian oil such as nearby Sri Lanka and China substantially increased its Iranian imports. However, reasonable consensus that Iran could, once the sanctions are lifted, bring 500Kbd back to the market within 90-days-time.

Saudi Arabia had until last year acted as the swing producer increasing or decreasing output to attempt to regulate the market price and keep prices high but now it is reluctant to do so when the other two largest producers the US and Russia continue to grow their production oblivious to the falling oil price as they seek to gain market share. With mounting fiscal deficits in some of the MENA countries the only solution is to pump more oil not less as in the past and compete for market share with the Non-OPEC producers rather than attempt to influence price. They need to take advantage of the current situation by introducing their consumers to the real cost of oil & gas by curtailing their subsidies and dampening down domestic demand growth to alleviate some of their fiscal pressures.

US Number One

US oil production reached 11mbd in 2014 and the US is expected to reach 13mbd usurping Saudi Arabia as the number 1 producer. In 2010 the US became the world’s largest gas producer and is on course to become the world’s largest oil producer. Its crude oil production increased by 16.2% (1.6mbd) in 2014 the largest ever increase since 1940. It has captured market share by stealth as up until last year it was the world’s largest consumer once consuming over 20mbd.

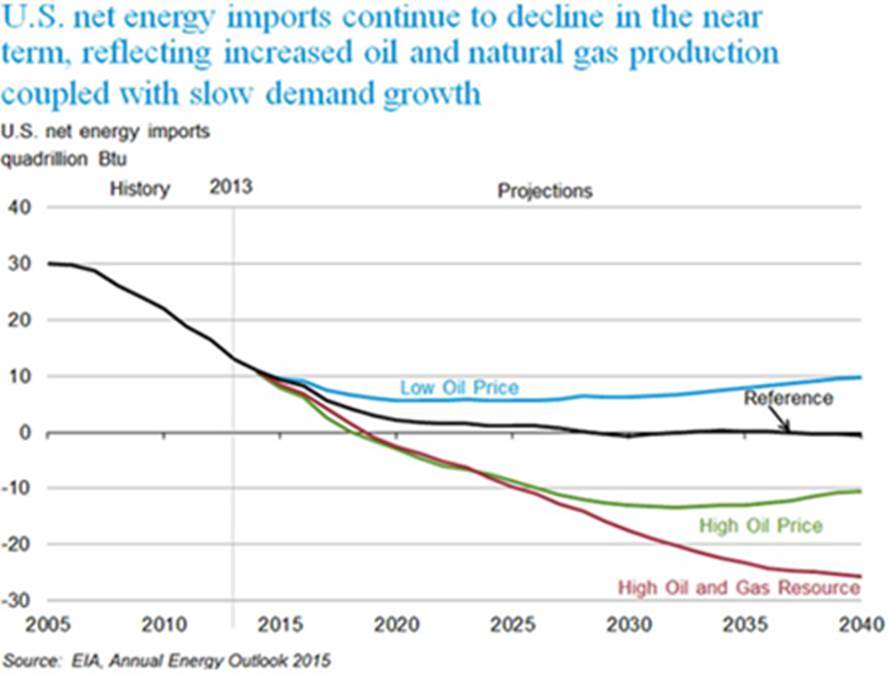

In recent years through energy efficiency policies its consumption has dropped by some 3mbd allowing China to become the largest consumer and net importer. At the same time, oil production has increased by some 3mbd and though exports of crude are currently banned because of existing legislation the exports of oil products have increased by the equivalent of 4mbd since 2010. The rapid development of unconventional oil and gas has been spectacular even though the current low prices are leading to the postponement of new oil wells being drilled output is still increasing by 10Kbd from existing wells whose marginal costs have fallen considerably. By now output growth in two of the three major basins, i.e. Bakken and Eagle Ford, is actually slowing, with only Permian still growing. US overall production may soon plateau but still new wells are coming on stream. As a consequence crude oil imports of 7mbd and 2mbd of oil products are likely to fall further leading to more oil seeking new customers on the world market. Net imports have fallen over the past four years and were only 5mbd as oil products exports reached 4mbd in 2014. US OPEC crude imports fell below 3mbd coming mostly from Saudi Arabia, Kuwait and Iraq with only nominal amounts from the UAE and Qatar. If the crude oil export ban is lifted, as expected, we might see further increases in supply as the US oil companies decide to invest at home rather than risk their investment abroad in unstable countries.

The rapid rise of US oil & gas production, falling imports, falling consumption and the rapid rise of oil products exports have had a significant impact on the market much of which has gone largely unreported outside of the industry.

The US and its neighbor Canada have both increased oil output and their response to the fall in oil prices has been to reduce the pace of production growth by reducing capital investment but output and capacity continues to grow. The US Energy Information Administration (EIA) expect US crude oil production to grow by 8.1% in 2015 slowing down considerably in 2016 to less than 2%. It is not just shale oil & gas production that is expected to continue to grow as 13 new fields in the Gulf of Mexico are due to come on stream by 2016. North America is not the only region where capacity and output is increasing.

Russia & Its Neighbours

Russia, the third largest oil producer, has slowly increased production going beyond 10mbd and sending oil exports towards 8mbd. Meanwhile investment in production capacity in its neighbours Turkmenistan, Kazakhstan and Azerbaijan continues to grow as they meet home demand and develop additional infrastructure capable of boosting exports of both oil and gas further. Caspian oil and gas exports are on the rise.

Slower Growth in Demand

The majority of analysts seem to believe that the world’s consumption of gasoline, diesel fuel, jet fuel, heating oil, and other petroleum products will continue to grow, as declining consumption in North America and Europe is more than outpaced by growth in Asia and other regions. The bullish amongst them see economic recovery in North America and Europe reversing the downward trend in consumption. The reality is somewhat different as energy efficiency measures combined with poor economic growth in the western world reduce demand. The economic austerity policies of Europe seem to have had a multiplier effect beyond their borders as Asian producers of consumer products see their sales growth fall and Asian economies suffer reduced growth rates. The poorer economies of Europe are taking the brunt of these austerity measures and these are the very economies one might have seen flourish like the Asian economies if their currencies were outside the Eurozone. So, the economic prospects for much of Europe remains bleak as they fail to compete with the rest of the world and a generation is lost to unemployment. The growth in world oil demand has slowed hovering around 90mbd since 2012 and the EIAs prediction for 2040 is now only 119mbd, a forecast figure that was once used for 2020.

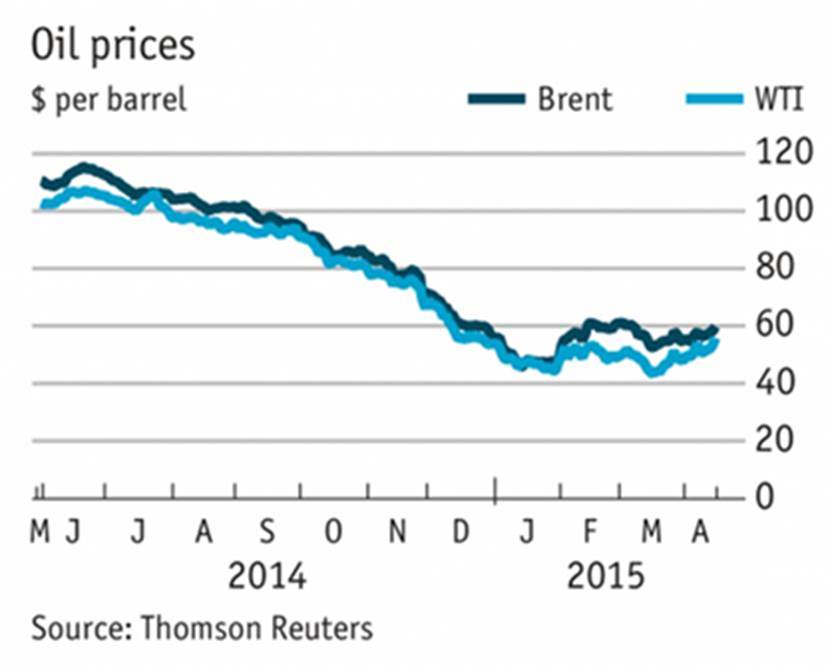

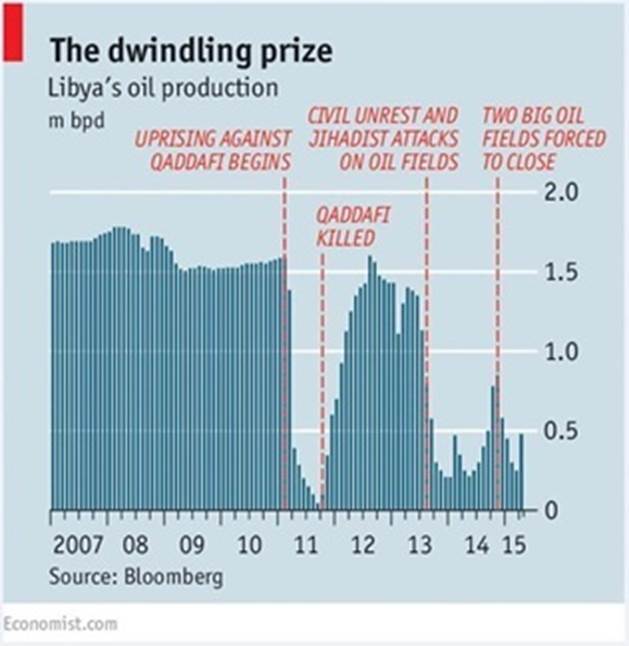

Short Term Price Instability

Commodity markets are notoriously unstable as they adjust to new structural highs or lows. Daily moves of 5% or more are not unusual especially as financial speculators feed off or create a diet of rumors and distorted facts such as huge Iranian stockpiles about to flood the market once the sanctions are lifted. Libya is a case in point. As the Qaddafi era ended the troubles created a substantial speculative price rise only for the rapid recovery in output to near pre Qaddafi levels to be largely ignored. Unlike the June-2014 oil supply increase in Libya, the 2015 fluctuations in Libyan production of some 500Kbd seem to have no impact on the world oil price whatsoever reflecting the oversupply in the market yet trouble in Yemen, a very minor producer, sends Brent oil up nearly 10% on geopolitical rumor. The daily movement in oil prices is not being helped by the notorious oil futures market where fortunes seem to be won or lost on rumor. Investment advisors are feeding the market with frequent stories of production leveling off now, next week, or next month trying to speculatively push up future prices somewhat ignoring record rising stock levels, US & OPEC production increases. Until the market reality of oversupply, production capacity increasing and low demand growth becomes widely accepted we can expect some short-term price fluctuations.

Conclusion

In recent years, the pace of oil production growth has raced ahead of the growth rate in demand and will continue to do so until at least 2016 as new fields are still coming on stream and as fields mature increasing output and efficiencies. The international oil companies yet again have had a knee jerk reaction to falling prices drastically cutting investment in any new wells but once again, they are closing the stable door after the horse has bolted. The writing has been on the wall since 2005/2006 when petroleum demand first fell in the US and Europe and has continued to do so every year since. The 2008 recession and the subsequent rejection of Keynesian policies by Europe in favor of austerity measures that have slowed down both European and world economic recovery and possibly condemned some European economies to permanent austerity has had an impact upon oil demand growth. The recent slowdown in China’s growth rate and elsewhere in Asia has only added to this scenario. If it were not for trouble in Libya, northern Iraq and Syria prices would be even lower and high prices are only likely to return if those funding the widening of the Sunni-Shia sectarian divide get their way and create yet another bottleneck in Middle Eastern production. World oil production needs to lose around 4% of current levels of production (91mb/day) before reaching $80 price a barrel again. Otherwise, oil prices are likely to remain low until at least the end of 2016 and probably for the foreseeable future hopefully fuelling economic growth in the world’s largest economies and stabilizing prices at around $60 where most producers gain reasonable profit margins. A price where the US, the new market leader, will benefit from a booming economy, an improved balance of payments, and greater market share in both oil & gas.

Source: The Huffington Post, 24/04/2015,

http://www.huffingtonpost.com/luay-al-khatteeb/are-low-oil-prices-here-t_b_7138522.html

Comment here