CAMBRIDGE – Ever since the late nineteenth century, when economics, increasingly embracing mathematics and statistics, developed scientific pretensions, its practitioners have been accused of a variety of sins. The charges – including hubris, neglect of social goals beyond incomes, excessive attention to formal techniques, and failure to predict major economic developments such as financial crises – have usually come from outsiders, or from a heterodox fringe. But lately it seems that even the field’s leaders are unhappy.

Paul Krugman, a Nobel laureate who also writes a newspaper column, has made a habit of slamming the latest generation of models in macroeconomics for neglecting old-fashioned Keynesian truths. Paul Romer, one of the originators of new growth theory, has accused some leading names, including the Nobel laureate Robert Lucas, of what he calls “mathiness” – using math to obfuscate rather than clarify.

Richard Thaler, a distinguished behavioral economist at the University of Chicago, has taken the profession to task for ignoring real-world behavior in favor of models that assume people are rational optimizers. And finance professor Luigi Zingales, also at the University of Chicago, has charged that his fellow finance specialists have led society astray by overstating the benefits produced by the financial industry.

This kind of critical examination by the discipline’s big names is healthy and welcome – especially in a field that has often lacked much self-reflection. I, too, have taken aim at the discipline’s sacred cows – free markets and free trade – often enough.

But there is a disconcerting undertone to this new round of criticism that needs to be made explicit – and rejected. Economics is not the kind of science in which there could ever be one true model that works best in all contexts. The point is not “to reach a consensus about which model is right,” as Romer puts it, but to figure out which model applies best in a given setting. And doing that will always remain a craft, not a science, especially when the choice has to be made in real time.

The social world differs from the physical world because it is man-made and hence almost infinitely malleable. So, unlike the natural sciences, economics advances scientifically not by replacing old models with better ones, but by expanding its library of models, with each shedding light on a different social contingency.

For example, we now have many models of markets with imperfect competition or asymmetric information. These models have not made their predecessors, based on perfect competition, obsolete or irrelevant. They have simply made us more aware that different circumstances call for different models.

Similarly, behavioral models that emphasize heuristic decision-making make us better analysts of environments where such considerations may be important. They do not displace rational-choice models, which remain the go-to tool in other settings. A growth model that applies to advanced countries may be a poor guide in developing countries. Models that emphasize expectations are sometimes best for analyzing inflation and unemployment levels; at other times, models with Keynesian elements will do a superior job.

Jorge Luis Borges, the Argentine writer, once wrote a short story – a single paragraph – that is perhaps the best guide to the scientific method. In it, he described a distant land where cartography – the science of making maps – was taken to ridiculous extremes. A map of a province was so detailed that it was the size of an entire city. The map of the empire occupied an entire province.

In time, the cartographers became even more ambitious: they drew a map that was an exact, one-to-one replica of the whole empire. As Borges wryly notes, subsequent generations could find no practical use for such an unwieldy map. So the map was left to rot in the desert, along with the science of geography that it represented.

Borges’s point still eludes many social scientists today: understanding requires simplification. The best way to respond to the complexity of social life is not to devise ever-more elaborate models, but to learn how different causal mechanisms work, one at a time, and then figure out which ones are most relevant in a particular setting.

We use one map if we are driving from home to work, another one if we are traveling to another city. Yet other kinds of maps are needed if we are on a bike, on foot, or planning to take public transport.

Navigating among economic models – choosing which one will work better – is considerably more difficult than choosing the right map. Practitioners use a variety of formal and informal empirical methods with varying skill. And, in my forthcoming book Economics Rules, I criticize economics training for not properly equipping students for the empirical diagnostics that the discipline requires.

But the profession’s internal critics are wrong to claim that the discipline has gone wrong because economists have yet to reach consensus on the “correct” models (their preferred ones of course). Let us cherish economics in all its diversity – rational and behavioral, Keynesian and Classical, first-best and second-best, orthodox and heterodox – and devote our energy to becoming wiser at picking which framework to apply when.

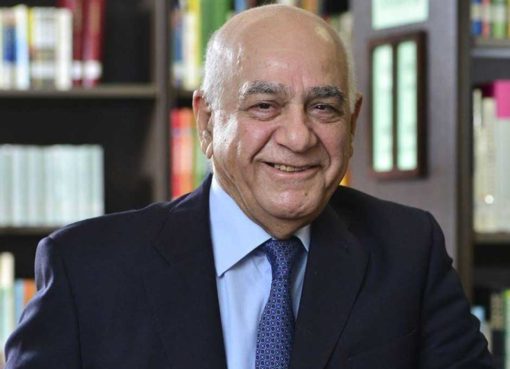

(*) Dani Rodrik is Professor of International Political Economy at Harvard University’s John F. Kennedy School of Government. He is the author of One Economics, Many Recipes: Globalization, Institutions, and Economic Growth and, most recently, The Globalization Paradox: Democracy and the Future of the World Economy

Source: Project Syndicate, SEP 10, 2015

https://www.project-syndicate.org/commentary/economists-versus-economics-by-dani-rodrik-2015-09

Comment here