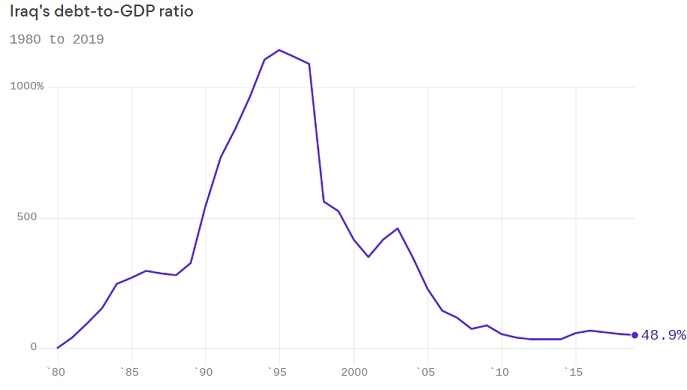

Data: Simon Hinrichsen / LSE; Chart: Axios Visuals

When the U.S. invaded Iraq in 2003, it was taking control of the most indebted nation in the world.

Why it matters: Iraq’s debt at the time was an astonishing $130 billion, and the eradication of that debt was a rare example of international unity and cooperation in the interests of a debtor country.

- The full story is told in “Tracing Iraqi Sovereign Debt Through Defaults

and Restructuring,” a new paper from the London School of Economics’ Simon Hinrichsen, who has also created the astonishing chart above. - To put these numbers in context: Japan’s current debt-to-GDP ratio is 238%, while the U.S. is at 106%. Iraq, in the mid-1990s, had a ratio well above 1,000%.

The big picture: Iraq had very few debts before the Iran-Iraq war of 1980–1988. Western countries armed Iraq during that war, and accepted IOUs for their weapons despite knowing that Iraq was already insolvent.

- In 1990, Iraq invaded Kuwait and, in so doing, lost the support of the West. Subsequent sanctions prompted Iraq’s economy to implode, sending its debt-to-GDP ratio into the stratosphere.

- After 1997, the United Nations’ oil-for-food program helped to get Iraq’s economy back onto its feet, and the debt-to-GDP ratio started falling. But the total amount of debt only fell after the U.S. invasion of Iraq in 2003.

After the war, the UN took the extraordinary step of immunizing all of Iraq’s assets from attachment by creditors. That put Iraq in an extremely strong negotiating position, and ultimately the country managed to persuade creditors to accept a reduction of 80% in the value of their debts.

Where it stands: Iraq today may be facing political turmoil, but its sovereign finances are in good shape, with a low debt-to-GDP ratio, substantial foreign reserves, and a healthy fiscal surplus.

Source: Axios, Januar 2, 2020

https://www.axios.com/iraq-debt-saga-dd0c186f-1bcd-4f95-bb4c-d650f5f45785.html

![Impact of the Oil Crisis and COVID-19 on Iraq’s Fragility [EN/AR/KU]](http://iraqieconomists.net/en/wp-content/uploads/sites/3/2020/08/Impact-of-the-Oil-Crisis-and-COVID-19-on-Iraq’s-Fragility-.jpg)

Comment here