Summary

The big development to note is the realignment of interests of regional players in a post-ISIS Iraq.

This should have a positive impact on the economy.

Ultimately, this will be reflected in increased liquidity in the equity market.

The equity market was mostly subdued through the dog days of summer but the big development to note is the realignment of interests of regional players in a post-ISIS Iraq with major implications for the Iraq investment story.

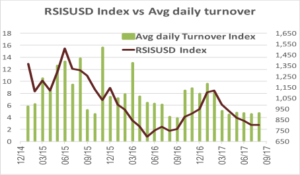

The equity market, as measured by the RSISUSD index, ended the month up +0.2% after trading in a tight range following the July sentiment turnaround, in which extremely depressed bank valuations drove locals to step up and absorb foreign selling as highlighted in last month’s piece on Iraq Business News. However, turnover continued to be low in-line with the last few months (see chart below) while foreign activity was mostly subdued with some re-emergence of selling in banks in the last few days but, at least for now, that has lost its ability to depress the overall market. The low turnover continues to emphasize the early phases of the liquidity recovery in the economy and the market.

Avg. daily turnover Index on the Iraq Stock Exchange [ISX] [green] vs RSISUSD Index [red]

(Source: Iraq Stock Exchange (ISX), Rabee Securities, Asia Frontier Capital)

Source:Seeking Alpha, September 5, 2017

https://seekingalpha.com/article/4104254-iraq-markets-realignment-regional-interests-post-isis

Comment here