Shipping is one of many sectors where Iraq is still playing catch-up after decades of conflict. To this end, the Iraqi Oil Tankers Company (IOTC) recently added a new oil products tanker to its small fleet. Its vessels mostly operate within Iraqi waters, shuttling heavy fuel oil from two ports in the south of the country.

The Sumer, a medium range ship with 31,000 deadweight tonnage (dwt) built in China, arrived in Iraq in September. IOTC is also set to receive a sister ship, the Akkad, constructed by the same shipbuilder and which departed for Basra on Dec. 1. The Iraqi company has portrayed the new vessels as part of its efforts to rebuild a fleet that once consisted of over 20 tankers. But major obstacles to its ambitions remain.

New tankers for shuttling fuel oil

IOTC’s fleet has for years consisted of only a few small vessels, between 13,000 dwt and 31,000 dwt. To shake things up, state-run IOTC in 2020 signed a contract with Norway’s Batservice Mandal to build the Sumer and Akkad. Iraqi officials described the move as a step towards reviving the role the company once played—particularly prior to Iraq’s invasion of Kuwait in 1990.

Today, the IOTC’s role is limited to transporting heavy fuel oil from the ports of Khor Al-Zubair and Umm Qasr to tankers serving as floating storage off the southern coast of Iraq. These operations are necessary because large and deep draught tankers cannot access the narrow and shallow water channel connecting the two ports to the Gulf region. Other state entities also operate tankers that have been chartered for the same purpose. For instance, the State Organization for Marketing of Oil (SOMO) has issued tenders for vessels to shuttle fuel oil.

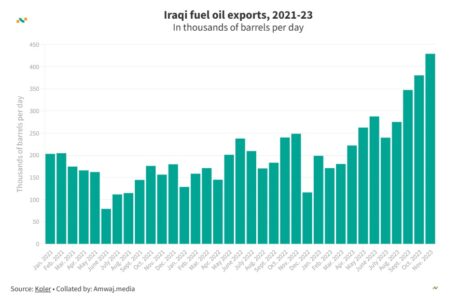

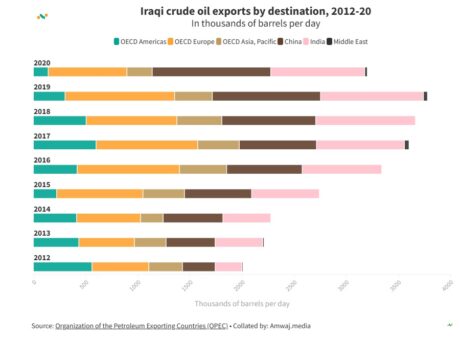

Iraqi fuel oil is coveted by mainly Chinese refiners as it can be further processed in complex refineries to produce products of higher value, such as gasoline. The petroleum product is sold in Asia and the United States among other destinations. It is also exported via the Emirati trading hub of Fujairah.

After being put into operation upon its arrival in Iraq in September, the Sumer has been moving fuel oil from Khor Al-Zubair to the nearby Erbil, a Very Large Crude Carrier (VLCC), according to data from Kpler. The Erbil is currently operated by Al-Iraqiya Shipping Services & Oil Trading (AISSOT), a joint venture formed in 2017 between IOTC and the Arab Maritime Petroleum Transport Company (AMPTC).

History of IOTC

“Our important plan is to expand the IOTC’s fleet and return this giant company to what it used to be and to a status similar to that of its regional counterparts,” company chief Ali Qais stated in an interview with local media last year.

Qais was likely referring to the early 1970s, when oil transportation in Iraq along with crude production and exports were nationalized. Prior to 1972, the Iraq Petroleum Company (IPC)—a consortium that included BP, Exxon, and Mobil among other major players—exercised full control over oil production.

The first Iraqi oil tanker to carry “nationally produced” crude was the Al-Rumaila, which embarked on its maiden voyage in Apr. 1972. According to the then-Iraqi Ministry of Information, the IOTC was established as an affiliate of the Iraqi National Oil Company (INOC) not long after A-Rumaila’s departure. By 1977, the company reportedly had plans for large crude carriers of 350,000 tonnage with eight such tankers ordered from Japan and Sweden. A decade later, the IOTC was operating over 20 tankers.

However, the multiple wars involving Iraq since that period has destroyed the company’s fleet. The Iraqi invasion of Kuwait, when some ships were used for military activities, was particularly destructive. During the Gulf War, at least one IOTC vessel was reportedly “fitted with anti-aircraft guns and sent into the Gulf as a support ship for four smaller Iraqi ships, three of which were sunk.” After the end of the conflict, some Iraqi ships were reported to have either been abandoned at ports around the world or sold for scrap.

Can the IOTC be revived?

The IOTC has been hoping to rebuild its fleet since at least 2004. The company first tried to set up a joint venture with Malaysian Merchant Marine (MMM), aspiring to acquire not only small vessels but also large ones including Suezmaxes and VLCCs. But those efforts did not lead anywhere, mostly due to the unstable conditions after the 2003 US-led invasion of Iraq.

Yet political instability did not prevent IOTC from acquiring small oil products tankers between 2007 and 2009 which remain in operation shuttling fuel oil. These ships include the Dijlah, IOTC’s first new vessel in over 20 years when it was delivered in 2007.

Throughout that period, there were various reports about how the IOTC wanted to revive its fleet as Iraq was planning to boost crude production. But instead of acquiring its own tonnage, the company started shopping for vessels in the charter markets. At the time, it was also looking for western technical expertise.

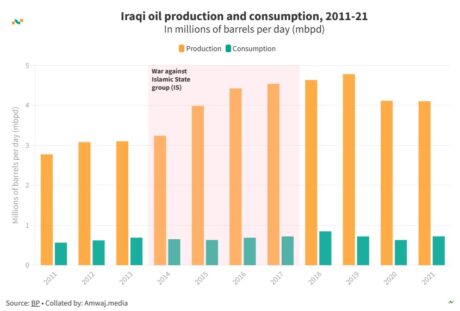

By 2017, as crude production surpassed 4M barrels per day, Iraqi officials were still talking about building a fleet of larger vessels that could access global markets. Yet, the IOTC’s fleet still consists of small vessels which mainly shuttle fuel oil. Having said that, Iraq has managed to charter VLCCs through joint ventures like the one with AISSOT. For instance, in 2018, the IOTC shipped 2M barrels of crude to the US on a self-run VLCC owned by a Greek shipowner and on a bareboat charter to AISSOT.

Amid ambiguities about the collaboration between the IOTC and Batservice to acquire the Sumer and Akkad, some industry experts speculate that the vessels could be on a bareboat charter, meaning that Iraq does not yet own them.

“A bareboat charter and leaseback deal to the Iraqis is the most likely business arrangement that could be concluded from the available information,” Michelle Wiese Bockmann, a shipping and energy commodities analyst at Lloyd’s List, told Amwaj.media. Batservice Holding AS is currently the beneficial owner of the Sumer, data from Lloyd’s List Intelligence show.

Ongoing challenges

As the IOTC aspires to regain its past glory, it cannot ignore the challenges it faces. Like other sectors in Iraq, the shipping industry still needs major restructuring to compete with regional fleets. For instance, Bahri—Saudi Arabia’s National Shipping Company—operates 39 VLCCs as well as 36 chemical and product tankers in addition to other types of vessels.

The IOTC director general has acknowledged that the main obstacles the company faces are bureaucratic; “laws and public regulations” which affect operations and expansion efforts. Qais has also noted issues with receiving government approvals to hire Iraqi graduates, knowing that the IOTC is suffering from a lack of skilled maritime staff. “Since it was established, the plan was for the IOTC to have 85% maritime staff and 15% administrative. Today, however, it is the other way around: 85% administrative and 15 % maritime,” he lamented.

Iraq does not only require investment in its tanker fleet but also its human resources. Additionally, the IOTC specifically needs to clarify its evolving operations and existing joint ventures as the country tries to rebuild itself after decades of damaging wars.

(*) Noam Raydan is a Senior Fellow at The Washington Institute for Near East Policy. She writes on topics related to the energy and shipping industries in the Middle East, with a particular focus on Lebanon and Iraq. Raydan was previously an independent energy researcher and consultant working in Baghdad and Beirut.

Her work has been published by leading media outlets and organizations including MEES, Forbes.com, Energy Fuse, and LOGI. She has also worked as a geopolitical analyst at ClipperData (now Kpler), a New York-based energy market research firm. Raydan additionally has extensive experience covering political and security developments in Syria, Lebanon, and Iraq for outlets such as the Wall Street Journal and the Financial Times. Some of her latest investigative work and research can be found on her Substack

Source: Amwaj, December 6, 2023

Why Iraq’s oil tanker ambitions have not made it to deep waters | Amwaj.media

Comment here