Two decades after the US invasion of Iraq, the civil war of the years that followed and the ravages of the Islamic State have faded into the background. Yet the country remains shaken by internal cleavages, torn apart by corruption, and vulnerable to influence operations by external actors. Overcoming economic crisis and infrastructural shortcomings could contribute to greater political stability.

- Oil production has doubled over the past two decades. The historical underdevelopment of the Iraqi oil sector has been reversed, yet the federal oil law has been contested between Baghdad and Erbil. Natural gas production has grown in recent years as well, but still falls short of providing enough energy to the power grid. The country is a net importer of natural gas, relying on supplies from Iran.

- Oil remains paramount for the Iraqi state, its budget, exports, and its economy. Heavy industries like fertilisers and petrochemicals could enhance the value chain of Iraq’s primary resources that include the second-largest phosphate reserves worldwide.

- Population growth in Iraq is still high. Beyond hydrocarbons, economic diversification in other areas is urgently needed. This could include alternative energies, light industries, education, services, water management, and a reorientation of agriculture.

- Iraq ranks 157 out of 180 in the Corruption Perception Index of Transparency International. Its consociational muhasasa system, which allocates power along sectarian lines, is abetting such corruption and thus requires reform.

Policy Implications

Iraq can be a vital partner for European energy cooperation and not only in hydrocarbons, but competition from China is stiff. Europe is already eyeing collaboration with Middle East and North Africa countries on the production of green hydrogen. Interconnectors of electricity grids within and beyond the region as well as storage solutions are needed to increase the share of renewables involved in power generation.

Political Instability and the Long-Term Consequences of the US Invasion

The US-led invasion and occupation of Iraq in 2003 was a watershed moment in recent history. It ended the reign of one of the most brutal ancien régimes in the Middle East and North Africa (MENA) region. Together with the invasion of Afghanistan two years earlier, these developments marked the beginning of American “forever wars,” split Europe into “old” and “new,” and shifted the regional power balance in favour of Iran. They also contributed to a more prominent regional role for other pivotal players such as Saudi Arabia and Turkey. For authoritarian rulers in the region and beyond valuable lessons were to be learned, leading to adaptations in their behaviours and repression strategies.

For Iraq, it meant another bout of political instability and violence after more than two decades of war and sanctions. Among the long-term effects of this war would be the rise and fall of the Islamic State and the increase in the number of Iraqi refugees seeking shelter in other countries of the Middle East and Europe. It prompted international powers to reconsider their stances towards multilateralism and sanctions, led to a steep surge in privatised mercenary warfare in the context of asymmetric conflicts, and raised questions about OPEC’s and Iraq’s role in international oil markets. The Iraq war increased European–Middle Eastern entanglement.

The legacy of Saddam Hussein’s Iraq left an imprint on successor regimes post-2003 in terms of institutions, policies, and infrastructures. With the dissolution of the Iraqi army and the Baath Party and the increased influence of two external actors (the US and Iran), there was an ostensible clean break at the level of institutions and the political system after 2003. Yet the sociopolitical conditions of the Saddam Hussein years and the politics of the Iraqi opposition in exile contributed to the emergence of a hybrid system that has combined formally democratic features with a reconstructed authoritarianism having sectarian overtones (Al-Ali 2014; Dodge 2013).

In contrast to the debates over continuities in the political realm, there has been institutional path dependency in the economic sphere. This ranges from the oil sector to the Public Distribution System that procures and allocates subsidised food, still existing to this day (Woertz 2017, 2019). The return of Iraq to international oil markets would raise questions about how it could be reintegrated into OPEC’s quota system and how its oil wealth could be harnessed to support economic diversification and job creation for a burgeoning youth population.

Iraq slid into civil war in the aftermath of the US invasion at a time of political change and attempts at economic reconstruction. Long-standing grievances over a lack of electricity, fresh water, and other necessities of life put a depleted infrastructure and the need to raise revenue to address such shortcomings into sharp relief. Political conflicts have their genuine dynamics, and socio-economic development can only go so far in ameliorating them. Yet the lack of such progress contributes to significant grievances, as the political protests seen in Iraq between 2019 and 2021 showed. Against this backdrop, prevalent development challenges merit more attention.

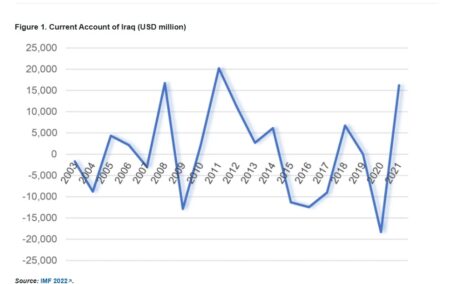

Hydrocarbons and Economic Development since 2003

Two decades of war and sanctions had devastated the Iraqi economy by 2003. Rebuilding the country’s infrastructure and raising the oil revenues necessary to do so were urgent priorities. With a total fertility rate of 3.55 children per woman, Iraq has still one of the higher birth rates in the MENA. The demographic transition is slower than in Iran, Lebanon, Tunisia, or Turkey, whose birth rates have all plummeted and hover around or even below the replacement level of 2.1 children per woman. This has resulted in steep population growth in Iraq, from 26 million people in 2003 to 43 million today. Just to maintain living standards the economy needs to grow substantially, and such progress still depends on oil revenues – whose share in overall gross domestic product has ranged between 32 and 45 per cent over the past decade (World Bank 2023).Volatility of export earnings constitutes a further vulnerability. When oil prices decline like they did in 2014, Iraq’s current account turns negative and state coffers empty (see Figure 1 below). Inflation adjusted GDP per capita grew from USD 7,700 in 2004 to more than USD 10,000 in 2013, but has since stagnated.

Figure 1. Current Account of Iraq (USD million)

Source: IMF 2022.

Iraq’s oil sector used to be underexplored due to historical circumstances, most notably the Red Line Agreement of 1928 in which international oil companies agreed to limit production to stabilise global oil prices. Saddam Hussein’s Baath regime felt it had to catch up and get its “fair share” of global oil exports. It was disinclined to follow OPEC production cuts in the 1970s during the Arab oil boycott, while expecting them from others. Prior to its invasion of Kuwait in 1990, it vocally demanded such production cuts from its neighbour to prop up global oil prices. After the sanctions-induced production shortfalls of the 1990s and then the events of 2003, Iraq would later once again be in a hurry to ramp up oil production amid US-led reconstruction efforts that were undermined by corruption and a lack of transparency (US Government 2013).

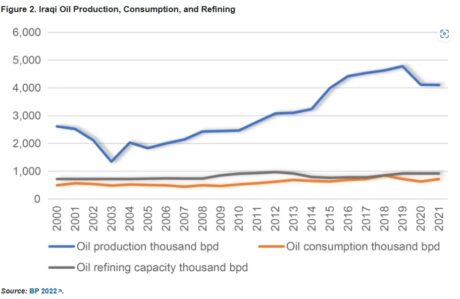

However, despite the prominent American role during the occupation period (until 2011), the Iraqi government did not offer lucrative production-sharing contracts to international oil companies. It was mainly Chinese and European oil companies, not American ones, that bid on less attractive service-provider contracts. Initial hopes that production could reach six million barrels per day (bpd) and higher have not materialised, yet oil production today has more than doubled from around two million bpd in 2004. As oil consumption has not grown in line with this, the exportable surplus has mounted up (see Figure 2 below). There would be an increase in refining capacity as well from 718,000 bpd in 2003 to 919,000 bpd in 2021, but this growth has not been as substantial – although it does roughly manage to meet domestic demand for petroleum products. Compared to Gulf Cooperation Council (GCC) countries such as Qatar, Saudi Arabia, and the United Arab Emirates that have sophisticated petrochemical industries, Iraq has not managed to enhance the value chain of its oil production in a similar fashion.

Figure 2. Iraqi Oil Production, Consumption, and Refining

Source: BP 2022.

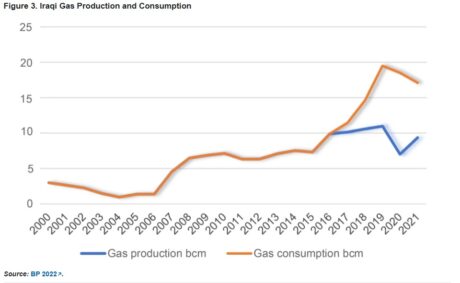

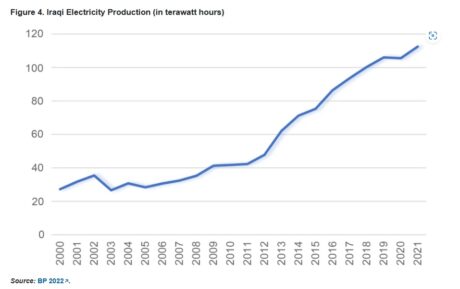

This is also true for natural gas production. Flaring of associated natural gas as a by-product of oil production has remained stubbornly high. It would grow from 7 billion cubic metres (bcm) in 2003 to 17.7 bcm in 2021, much higher than actual natural gas production of 9.4 bcm that is needed for power generation (see Figure 3 below). The latter is a highly contentious issue in Iraqi politics because of the frequent blackouts in the country. Electricity-production growth has picked up over the past decade (see Figure 4 below). As domestic gas reserves have not been sufficiently developed, however, power plants have to be fuelled by crude oil as well – which compromises export capacity. This shortfall is also offset via the natural gas imports from Iran that started in 2017. Such imports have become a crucial part of Iraq’s energy mix, but at times it has struggled to pay for them and the country required an exemption from US sanctions against Iran to even maintain them (PBS 2020). Iraq has started to export some natural gas as LNG from Umm Qasr port in 2022. In the wake of interrupted flows of Russian gas Europeans have laid eyes on such export potential, not least the German government whose Minister of Foreign Affairs Annalena Baerbock visited the country in March 2023. However, the bottom line is that Iraq remains a net-importer of natural gas. Barring further developments of existing gas reserves, growing exports would compromise domestic supplies.

Figure 3. Iraqi Gas Production and Consumption

Source: BP 2022.

Figure 4. Iraqi Electricity Production (in terawatt hours)

Source: BP 2022.

Economic Diversification, Energy Transitions, and International Cooperation

Iraq’s dependence on oil to fuel its economy engenders political mechanisms of rent redistribution, resource capture by elites, neglect of productive sectors of the economy, shortcomings in the educational realm, and other phenomena that have been associated with the “resource curse” that afflicts economies reliant on the export of raw materials. Yet, it needs to be acknowledged that energy is a prerequisite of development anywhere. Further, the hydrocarbon sector and its revenues certainly have their role to play in the Iraqi economy going forwards.

Building up refining capacity to enhance the value chain of hydrocarbon production and expand into petrochemicals represents a key window of opportunity. Iraq had a flourishing fertiliser industry in the 1970s and 1980s, before it fell into disrepair under sanctions (Tollast and Mahmoud 2022). Petrochemicals are a growth market that is less likely to face demand destruction compared to other petroleum products such as gasoline that will grapple with the growing electrification of transport. The same is true for developing gas reserves that are currently being flared. Besides domestic power production, these resources could also be used in petrochemical industries such as fertiliser production. Apart from nitrogen fertiliser, this could include phosphates. After discovery of a world-class deposit in its Anbar Province, Iraq commands about 9 per cent of global reserves hereof – second only to Morocco (Woertz 2014).

Even if Iraq were able to replicate the successful strategies of some GCC countries in petrochemicals, the employment intensity of such heavy industries is limited. To create jobs for its burgeoning youth population, Iraq will require economic diversification. Given the country’s huge need for infrastructure and residential housing, the construction sector and the cement industry have been booming. The same is true for mobile phones, which went from virtually zero to almost universal coverage in the first decade of the new century, leapfrogging landline communications and providing Internet access. Tourism, a typical candidate in other MENA countries, is unlikely to be realistic for the foreseeable future given continued unrest in the country further to its acute infrastructural shortcomings. As a largely landlocked state, logistics and trade are less obvious than in coastal countries such as Lebanon, Morocco, or the UAE. Yet, Iraq’s strategic location at the heart of the MENA region might offer certain opportunities at least. The same is true for light industries and food processing, although its experience in these fields is limited.

Agriculture is only contributing around 4 per cent of value added to Iraq’s GDP, but its share in employment is still substantial at 18 per cent – albeit it has come down from 23 per cent over the course of the last decade. Besides imports, agriculture is a crucial supplier to the country’s aforementioned Public Distribution System, the world’s largest public food programme. It supplies basic staples to the majority of the population at subsidised rates. Agriculture is also at the heart of Iraq’s multiple environmental crises. The country is heavily affected by climate change, sandstorms, overextraction of groundwater, reduced flows of surface water from Turkey, salinisation of soils, and saltwater intrusion in rivers and aquifers in its southern coastal region. Environmental rehabilitation and more sustainable forms of agriculture are urgently needed. The government has focused on an increase in water-intensive wheat cultivation, but fruit and vegetables that are still mainly imported from neighbouring countries such as Iran and Turkey might offer better opportunities here; the same goes for sustainable forms of livestock grazing and production.

Iraq’s exposure to environmental hazards points to the challenge of climate change mitigation. Energy transitions away from hydrocarbons are a prerequisite for such endeavours, including via the increased use of renewables in power generation, the electrification of transport, and the use of green hydrogen in sectors that are difficult to electrify such as heavy industry, aviation, or shipping. For a lack of space, the European Union plans to import a large share of its future green hydrogen needs from countries abroad – among them, the MENA ones (Lenivova 2022). Morocco, Saudi Arabia, and the UAE are in advanced talks here. Germany’s H2Diplo initiative that aims to foster an emerging green hydrogen economy has opened an office in Riyadh, for example (German Ministry of Foreign Affairs 2023).

The interest of oil exporters in energy transitions appears counterintuitive, as they stand to lose significant revenue herewith. Yet, the UAE has declared its ambition to reach net-zero status by 2050 and Saudi Arabia by 2060. In a world of reduced oil demand by the mid-2030s, they see themselves as the last ones standing in global oil markets because of their low production costs and industrial capacity to serve the still-expanding market for petrochemical products. At the same time, they aim to use alternative energies to satisfy domestic energy demand and safeguard oil-related export capacity (England and Al-Atrush 2022).

In comparison, Iraq is behind the curve and has less fiscal room to manoeuvre – yet it could adopt aspects of that strategy at least. Together with storage solutions, grid interconnections could help to address the issue of the intermittency of renewables and ease their integration into existing energy mixes. Iraq is part of the EIJLLPST interconnection that includes Egypt, Jordan, Lebanon, Libya, Palestine, Syria, and Turkey. It was initiated in 1988 already, but has not yet led to any significant level of interconnection. Due to geographic proximity and a diplomatic thaw in recent years, an Iraqi connection with the GCC interconnectionof the Gulf Cooperation Council Interconnection Authority might be more promising. It was launched in 2001, is more advanced, and could be a future reference point for the development of a “Pan-Arab Electricity Market.”

Iraq’s Economy and Cooperation with Europe

As Europe is revisiting its energy-security strategy in the wake of Russia’s invasion of Ukraine, it should not regard Iraq as a mere supplier of oil and potentially natural gas. The harnessing of both resources must be aligned with Iraq’s own development ambitions, including its domestic energy requirements and increased need for economic diversification. Considerable cooperation potential exists in areas such as water management, power generation, education, and renewables. This could include on trans-Mediterranean interconnectors; triangular cooperation with GCC countries on development assistance is another possibility, too (Woertz and Schuetze 2022). There is a tendency towards “splendid isolation” in the way Europeans look to the MENA. Unlike their Chinese competitors, they spot risks more easily than opportunities – a prioritisation they might want to now reconsider.

References

Al-Ali, Zaid (2014), The Struggle for Iraqʼs Future: How Corruption, Incompetence and Sectarianism have Undermined Democracy, New Haven, London: Yale University Press.

BP (2022), Statistical Review of World Energy 2022, accessed 21 December 2022.

Dodge, Toby (2013), Iraq: From War to a New Authoritarianism, Adelphi Series, London, New York: Routledge for The International Institute for Strategic Studies.

England, Andrew, and Samer Al-Atrush (2022), Saudi Arabia’s Green Agenda: Renewables at Home, Oil Abroad, in: Financial Times, 22 November.

German Ministry of Foreign Affairs (2023), H2Diplo: Global Hydrogen Diplomacy, accessed 19 February 2023.

IMF (2022), World Economic Outlook Dataset, October 2022, accessed 9 February 2023.

Lenivova, Veronika (2022), Potential Development of Renewable Hydrogen Imports to European Markets Until 2030, Oxford Institute for Energy Studies (Oxford), 22 March, accessed 27 February 2023.

PBS (2020), U.S. Gives Iraq Sanctions Waiver for Vital Iranian Gas Imports, 12 February, accessed 19 February 2023.

Tollast, Robert, and Sinan Mahmoud (2022), Iraq Scrambles to Regrow Its Once World-Leading Fertiliser Industry, in: The National, 29 July, accessed 27 February 2023.

US Government (2013), Learning from Iraq. A Final Report from the Special Inspector General for Iraq Reconstruction, March, Washington, DC.

Woertz, Eckart (2019), Iraq under UN Embargo, 1990–2003: Food Security, Agriculture, and Regime Survival, in: Middle East Journal, 73, 1, 92–111.

Woertz, Eckart (2017), Food Security in Iraq: Results from Quantitative and Qualitative Surveys, in: Food Security, 9, 3, 511–522.

Woertz, Eckart (2014), Mining Strategies in the Middle East and North Africa, in: Third World Quarterly, 35, 6, 939–957.

Woertz, Eckart, and Benjamin Schuetze (2022), Unlikely Companions of Energy Transitions? Opportunities and Challenges of Triangular Cooperation between the EU and the GCC in the Middle East and North Africa (MENA), EUROMESCO (Barcelona), September.

World Bank (2023), Oil Rents (% of GDP) – Iraq, accessed 16 February 2023.

(*) Prof. Dr. Eckart Woertz is Director of the GIGA Institute for Middle East Studies / Editor GIGA Focus Middle East

Source: German Institute for Global and Area Studies (GIGA)

Iraq 20 Years after the US Invasion: Challenges and Continuity (giga-hamburg.de)

Comment here